Question: Safari File Edit View History Bookmarks Develop Window Help 89%C4) Mon 6:25 PM Q mathxl.com Fin 313 Spring 2021 All Sections Ryan Uglow | 05/17/21

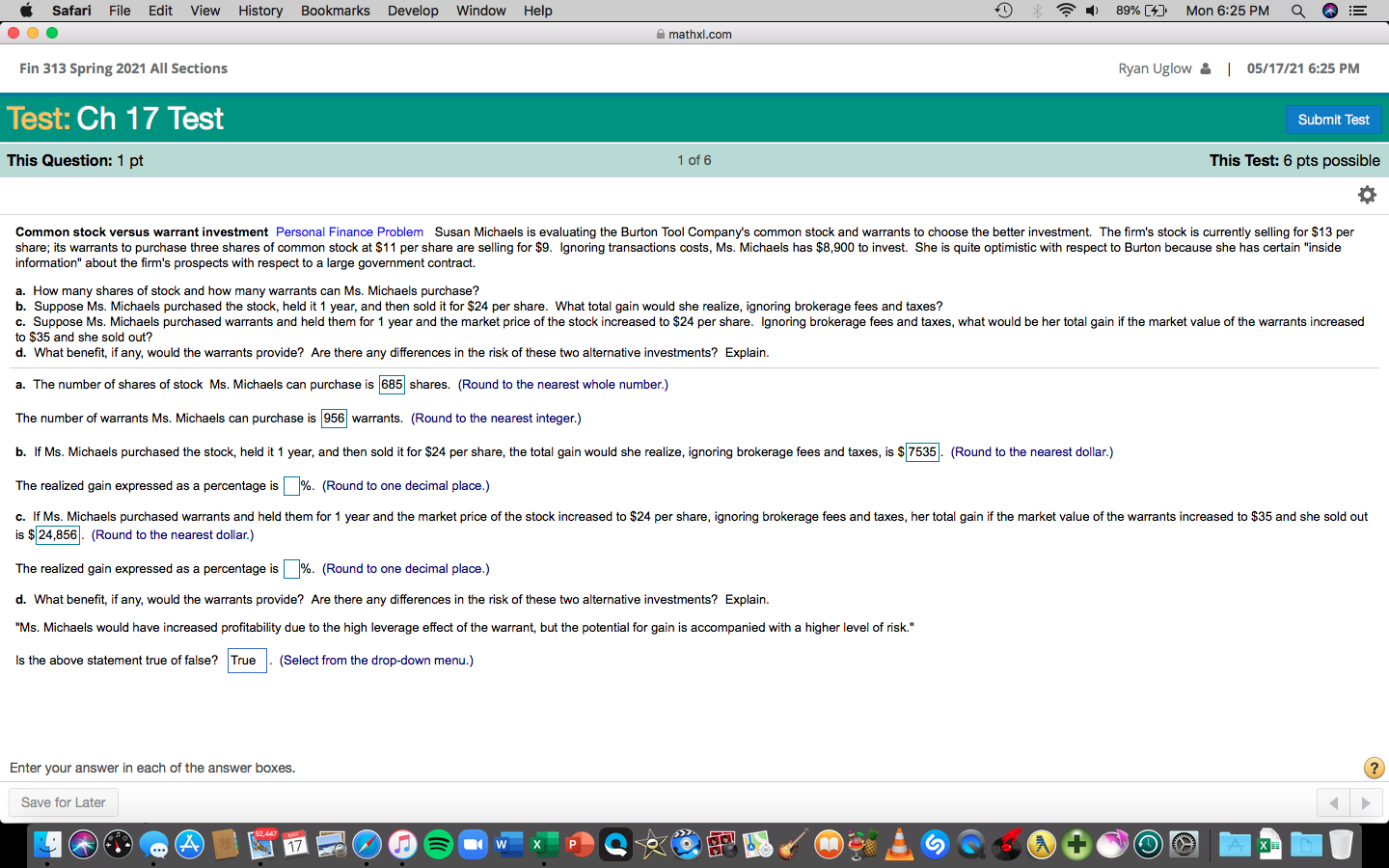

Safari File Edit View History Bookmarks Develop Window Help 89%C4) Mon 6:25 PM Q mathxl.com Fin 313 Spring 2021 All Sections Ryan Uglow | 05/17/21 6:25 PM Test: Ch 17 Test Submit Test This Question: 1 pt 1 of 6 This Test: 6 pts possible Common stock versus warrant investment Personal Finance Problem Susan Michaels is evaluating the Burton Tool Company's common stock and warrants to choose the better investment. The firm's stock is currently selling for $13 per share; its warrants to purchase three shares of common stock at $11 per share are selling for $9. Ignoring transactions costs, Ms. Michaels has $8,900 to invest. She is quite optimistic with respect to Burton because she has certain "inside information" about the firm's prospects with respect to a large government contract. a. How many shares of stock and how many warrants can Ms. Michaels purchase? b. Suppose Ms. Michaels purchased the stock, held it 1 year, and then sold it for $24 per share. What total gain would she realize, ignoring brokerage fees and taxes? c. Suppose Ms. Michaels purchased warrants and held them for 1 year and the market price of the stock increased to $24 per share. Ignoring brokerage fees and taxes, what would be her total gain if the market value of the warrants increased to $35 and she sold out? d. What benefit, if any, would the warrants provide? Are there any differences in the risk of these two alternative investments? Explain. a. The number of shares of stock Ms. Michaels can purchase is 685 shares. (Round to the nearest whole number.) The number of warrants Ms. Michaels can purchase is 956 warrants. (Round to the nearest integer.) b. If Ms. Michaels purchased the stock, held it 1 year, and then sold it for $24 per share, the total gain would she realize, ignoring brokerage fees and taxes, is $ 7535. (Round to the nearest dollar.) The realized gain expressed as a percentage is%. (Round to one decimal place.) c. If Ms. Michaels purchased warrants and held them for 1 year and the market price of the stock increased to $24 per share, ignoring brokerage fees and taxes, her total gain if the market value of the warrants increased to $35 and she sold out is $ 24,856. (Round to the nearest dollar.) The realized gain expressed as a percentage is %. (Round to one decimal place.) d. What benefit, if any, would the warrants provide? Are there any differences in the risk of these two alternative investments? Explain. "Ms. Michaels would have increased profitability due to the high leverage effect of the warrant, but the potential for gain is accompanied with a higher level of risk." Is the above statement true of false? True (Select from the drop-down menu.) Enter your answer in each of the answer boxes. ? Save for Later 52,447 17 Safari File Edit View History Bookmarks Develop Window Help 89%C4) Mon 6:25 PM Q mathxl.com Fin 313 Spring 2021 All Sections Ryan Uglow | 05/17/21 6:25 PM Test: Ch 17 Test Submit Test This Question: 1 pt 1 of 6 This Test: 6 pts possible Common stock versus warrant investment Personal Finance Problem Susan Michaels is evaluating the Burton Tool Company's common stock and warrants to choose the better investment. The firm's stock is currently selling for $13 per share; its warrants to purchase three shares of common stock at $11 per share are selling for $9. Ignoring transactions costs, Ms. Michaels has $8,900 to invest. She is quite optimistic with respect to Burton because she has certain "inside information" about the firm's prospects with respect to a large government contract. a. How many shares of stock and how many warrants can Ms. Michaels purchase? b. Suppose Ms. Michaels purchased the stock, held it 1 year, and then sold it for $24 per share. What total gain would she realize, ignoring brokerage fees and taxes? c. Suppose Ms. Michaels purchased warrants and held them for 1 year and the market price of the stock increased to $24 per share. Ignoring brokerage fees and taxes, what would be her total gain if the market value of the warrants increased to $35 and she sold out? d. What benefit, if any, would the warrants provide? Are there any differences in the risk of these two alternative investments? Explain. a. The number of shares of stock Ms. Michaels can purchase is 685 shares. (Round to the nearest whole number.) The number of warrants Ms. Michaels can purchase is 956 warrants. (Round to the nearest integer.) b. If Ms. Michaels purchased the stock, held it 1 year, and then sold it for $24 per share, the total gain would she realize, ignoring brokerage fees and taxes, is $ 7535. (Round to the nearest dollar.) The realized gain expressed as a percentage is%. (Round to one decimal place.) c. If Ms. Michaels purchased warrants and held them for 1 year and the market price of the stock increased to $24 per share, ignoring brokerage fees and taxes, her total gain if the market value of the warrants increased to $35 and she sold out is $ 24,856. (Round to the nearest dollar.) The realized gain expressed as a percentage is %. (Round to one decimal place.) d. What benefit, if any, would the warrants provide? Are there any differences in the risk of these two alternative investments? Explain. "Ms. Michaels would have increased profitability due to the high leverage effect of the warrant, but the potential for gain is accompanied with a higher level of risk." Is the above statement true of false? True (Select from the drop-down menu.) Enter your answer in each of the answer boxes. ? Save for Later 52,447 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts