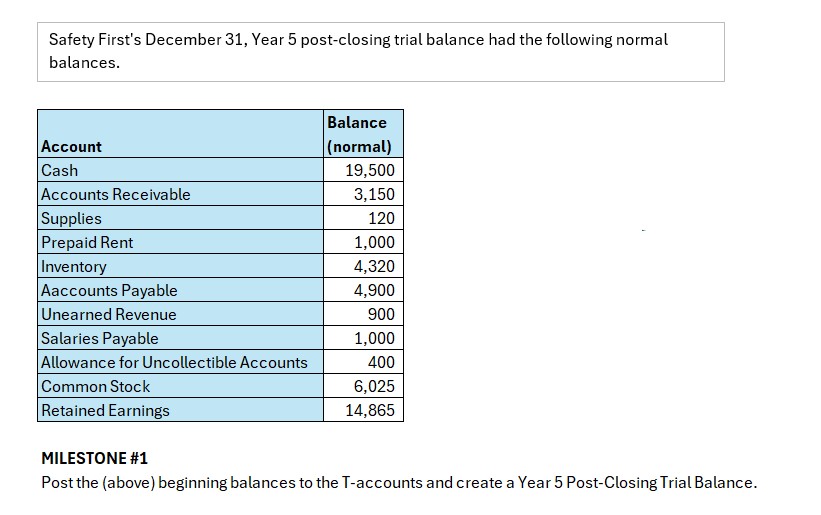

Question: Safety First's December 3 1 , Year 5 post - closing trial balance had the following normal balances. begin { tabular } { |

Safety First's December Year postclosing trial balance had the following normal balances.

begintabularlr

hline Account & begintabularl

Balance

normal

endtabular

hline Cash &

hline Accounts Receivable &

hline Supplies &

hline Prepaid Rent &

hline Inventory &

hline Aaccounts Payable &

hline Unearned Revenue &

hline Salaries Payable &

hline Allowance for Uncollectible Accounts &

hline Common Stock &

hline Retained Earnings &

hline

endtabular

MILESTONE #

Post the above beginning balances to the Taccounts and create a Year PostClosing Trial Balance. During Year Safety First experienced the following transactions:

On Feb Year created a petty cash fund, initally setting the fund at $

Paid $ on March Year for one year's lease in advance on the company van.

Paid $ on May Year for one year's office rent in advance.

Purchased $ of supplies on account on May Year

On June Year paid cash to purchase alarm systems at a cost of $ each.

In trying to collect on two pastdue accounts, Restaurant Rentals and Suave Inc. see Acct

On June Year sold alarm systems for $ All sales were on account to a new

On June Year received onehalf of the amount owed by Templaton net of discount

Only July Year Safety First replenished the petty cash fund. The fund contained $ off

On August Year paid cash to purchase alarm systems at a cost of $ each.

Safety First began accepting credit cards for some of its monitoring service sales. The credit

Collected the amount due from the credit card company and $ from customer Gagne.

On Dec Year sold alarm systems for $ to ZZYZ Inc. with terms Net

Paid $ on accounts payable.

Paid $ for salaries during the year.

Paid $ of advertising expenses for the year.

Collected $ of accounts receivable from Templaton after the discount period.

Paid $ of operating expense during the year.

Paid $ in dividends to stockholders.

MILESTONE

Record all orginating transactions in the general journal. Post transactions to the TAccounts and create an For transactions that impact Accounts Receivable or Inventory, track the changes in the Acct Receivable or Inventory Detail worksheet. After some analysis, you determine that First Safety needs to record the following adjusting entries.

There was $ of supplies on hand at the end of the year

Prepaid rent has expired and needs to be expensed.

Owe, but have not paid for $ in operating expense at the end of the year.

Accrued salaries were $ at December Year

Safety First estimates that the following in estimating uncollectible accounts.

Safety First records the appropriate amount for uncollectible accounts.

Earned $ of the unearned revenue from services provided and previously paid for.

Recognized expired amount of prepaid lease on van.

After completing the yearend physical inventory and reviewing inventory value, determine that

Milestone

Using Milestone information, record the above adjusting transactions in the general journal. Post transactions to the TAccounts and create an Adjusted Trial Balance. For transactions that impact Accounts Receivable or Inventory, track the changes in the Acct Receivable or Inventory Detail worksheet.

Create yearend financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock