Question: Sahitya Enterprises is currently evaluating a capital project for which they have provided the following details: The initial investment required for the project amounts to

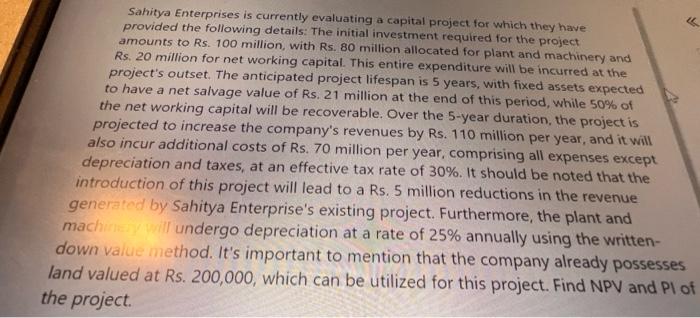

Sahitya Enterprises is currently evaluating a capital project for which they have provided the following details: The initial investment required for the project amounts to Rs. 100 million, with Rs. 80 million allocated for plant and machinery and Rs, 20 million for net working capital. This entire expenditure will be incurred at the project's outset. The anticipated project lifespan is 5 years, with fixed assets expected to have a net salvage value of Rs. 21 million at the end of this period, while 50% of the net working capital will be recoverable. Over the 5 -year duration, the project is projected to increase the company's revenues by Rs. 110 million per year, and it will also incur additional costs of Rs. 70 million per year, comprising all expenses except depreciation and taxes, at an effective tax rate of 30%. It should be noted that the introduction of this project will lead to a Rs. 5 million reductions in the revenue generatod by Sahitya Enterprise's existing project. Furthermore, the plant and mach Undergo depreciation at a rate of 25% annually using the writtendown valuc method. It's important to mention that the company already possesses land valued at Rs. 200,000, which can be utilized for this project. Find NPV and PI o the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts