Question: Sakura Bloom Sdn. Bhd. is a small medium enterprise located in the heart of bustling Kuala Lumpur. The company has been manufacturing premium mineral foundation

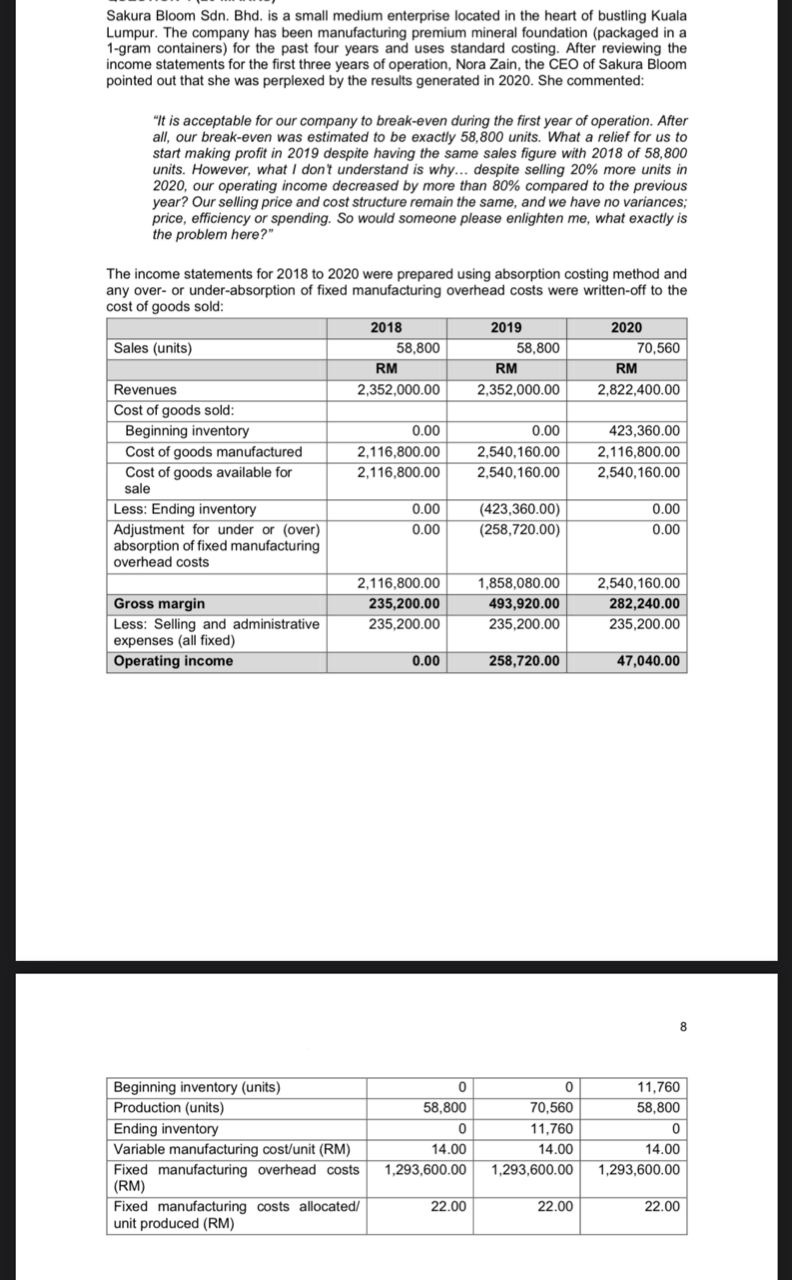

Sakura Bloom Sdn. Bhd. is a small medium enterprise located in the heart of bustling Kuala Lumpur. The company has been manufacturing premium mineral foundation (packaged in a 1-gram containers) for the past four years and uses standard costing. After reviewing the income statements for the first three years of operation, Nora Zain, the CEO of Sakura Bloom pointed out that she was perplexed by the results generated in 2020. She commented: "It is acceptable for our company to break-even during the first year of operation. After all, our break-even was estimated to be exactly 58,800 units. What a relief for us to start making profit in 2019 despite having the same sales figure with 2018 of 58,800 units. However, what I don't understand is why... despite selling 20% more units in 2020, our operating income decreased by more than 80% compared to the previous year? Our selling price and cost structure remain the same, and we have no variances; price, efficiency or spending. So would someone please enlighten me, what exactly is the problem here?" The income statements for 2018 to 2020 were prepared using absorption costing method and any over- or under-absorption of fixed manufacturing overhead costs were written-off to the cost of goods sold: 2018 2019 2020 Sales (units) 58,800 58,800 70,560 RM RM RM Revenues 2,352,000.00 2,352,000.00 2,822,400.00 Cost of goods sold: Beginning inventory 0.00 0.00 423,360.00 Cost of goods manufactured 2,116,800.00 2,540,160.00 2,116,800.00 Cost of goods available for 2,116,800.00 2,540,160.00 2,540,160.00 sale Less: Ending inventory 0.00 (423,360.00) 0.00 Adjustment for under or (over) D.00 (258,720.00) 0.00 absorption of fixed manufacturing overhead costs 2,116,800.00 1,858,080.00 2,540,160.00 Gross margin 235,200.00 493,920.00 282,240.00 Less: Selling and administrative 235,200.00 235,200.00 235,200.00 expenses (all fixed) Operating income 0.00 258,720.00 47,040.00 8 Beginning inventory (units) 0 0 11,760 Production (units) 58,800 70,560 58,800 Ending inventory 11,760 Variable manufacturing cost/unit (RM) 14.00 14.00 14.00 Fixed manufacturing overhead costs 1,293,600.00 1,293,600.00 1,293,600.00 (RM) Fixed manufacturing costs allocated/ 22.00 22.00 22.00 unit produced (RM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts