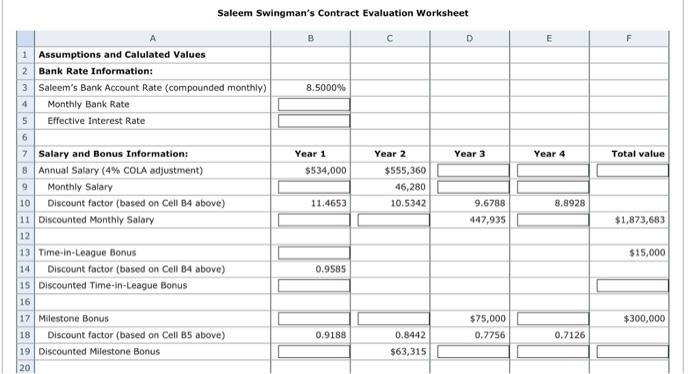

Question: Saleem Swingman's Contract Evaluation Worksheet B D E F 8.5000% Year 3 Year 4 Total value Year 1 $534,000 Year 2 $555,360 46,280 10.5342 11.4653

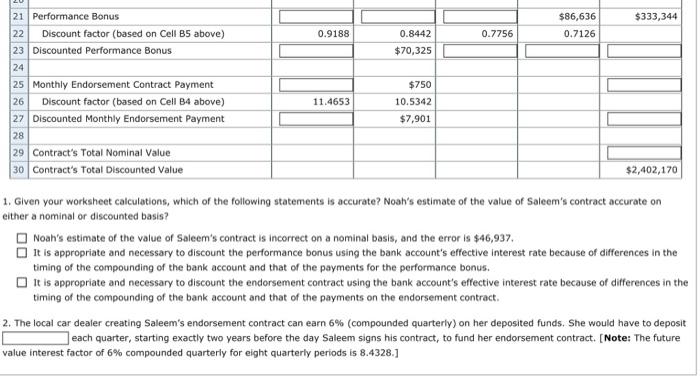

Saleem Swingman's Contract Evaluation Worksheet B D E F 8.5000% Year 3 Year 4 Total value Year 1 $534,000 Year 2 $555,360 46,280 10.5342 11.4653 8.8928 1 Assumptions and Calulated Values 2 Bank Rate Information: 3 Saleem's Bank Account Rate (compounded monthly) 4 Monthly Bank Rate 5 Effective interest Rate 6 7 Salary and Bonus Information: 8 Annual Salary (4% COLA adjustment) 9 Monthly Salary 10 Discount factor (based on Cell B4 above) 11 Discounted Monthly Salary 12 13 Time-in-League Bonus Discount factor (based on Cell B4 above) 15 Discounted Time-in-League Bonus 16 17 Milestone Bonus 18 Discount factor (based on Cell B5 above) 19 Discounted Milestone Bonus 20 9.6788 447,935 $1,873,683 $15,000 0.9585 $300,000 $75,000 0.7756 0.9188 0.7126 0.8442 $63,315 $86,636 $333,344 0.9188 0.8442 0.7756 0.7126 $70,325 21 Performance Bonus 22 Discount factor (based on Cell B5 above) 23 Discounted Performance Bonus 24 25 Monthly Endorsement Contract Payment 26 Discount factor (based on Cell B4 above) 27 Discounted Monthly Endorsement Payment 28 29 Contract's Total Nominal Value 30 Contract's Total Discounted Value 11.4653 $750 10.5342 $7,901 $2,402,170 1. Given your worksheet calculations, which of the following statements is accurate? Noah's estimate of the value of Saleem's contract accurate on either a nominal or discounted basis? Noah's estimate of the value of Saleem's contract is incorrect on a nominal basis, and the error is $46,937. It is appropriate and necessary to discount the performance bonus using the bank account's effective interest rate because of differences in the timing of the compounding of the bank account and that of the payments for the performance bonus. It is appropriate and necessary to discount the endorsement contract using the bank account's effective interest rate because of differences in the timing of the compounding of the bank account and that of the payments on the endorsement contract. 2. The local car dealer creating Saleem's endorsement contract can earn 6% (compounded quarterly) on her deposited funds. She would have to deposit each quarter, starting exactly two years before the day Saleem signs his contract, to fund her endorsement contract. [Note: The future value interest factor of 6% compounded quarterly for eight quarterly periods is 8.4328.] Saleem Swingman's Contract Evaluation Worksheet B D E F 8.5000% Year 3 Year 4 Total value Year 1 $534,000 Year 2 $555,360 46,280 10.5342 11.4653 8.8928 1 Assumptions and Calulated Values 2 Bank Rate Information: 3 Saleem's Bank Account Rate (compounded monthly) 4 Monthly Bank Rate 5 Effective interest Rate 6 7 Salary and Bonus Information: 8 Annual Salary (4% COLA adjustment) 9 Monthly Salary 10 Discount factor (based on Cell B4 above) 11 Discounted Monthly Salary 12 13 Time-in-League Bonus Discount factor (based on Cell B4 above) 15 Discounted Time-in-League Bonus 16 17 Milestone Bonus 18 Discount factor (based on Cell B5 above) 19 Discounted Milestone Bonus 20 9.6788 447,935 $1,873,683 $15,000 0.9585 $300,000 $75,000 0.7756 0.9188 0.7126 0.8442 $63,315 $86,636 $333,344 0.9188 0.8442 0.7756 0.7126 $70,325 21 Performance Bonus 22 Discount factor (based on Cell B5 above) 23 Discounted Performance Bonus 24 25 Monthly Endorsement Contract Payment 26 Discount factor (based on Cell B4 above) 27 Discounted Monthly Endorsement Payment 28 29 Contract's Total Nominal Value 30 Contract's Total Discounted Value 11.4653 $750 10.5342 $7,901 $2,402,170 1. Given your worksheet calculations, which of the following statements is accurate? Noah's estimate of the value of Saleem's contract accurate on either a nominal or discounted basis? Noah's estimate of the value of Saleem's contract is incorrect on a nominal basis, and the error is $46,937. It is appropriate and necessary to discount the performance bonus using the bank account's effective interest rate because of differences in the timing of the compounding of the bank account and that of the payments for the performance bonus. It is appropriate and necessary to discount the endorsement contract using the bank account's effective interest rate because of differences in the timing of the compounding of the bank account and that of the payments on the endorsement contract. 2. The local car dealer creating Saleem's endorsement contract can earn 6% (compounded quarterly) on her deposited funds. She would have to deposit each quarter, starting exactly two years before the day Saleem signs his contract, to fund her endorsement contract. [Note: The future value interest factor of 6% compounded quarterly for eight quarterly periods is 8.4328.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts