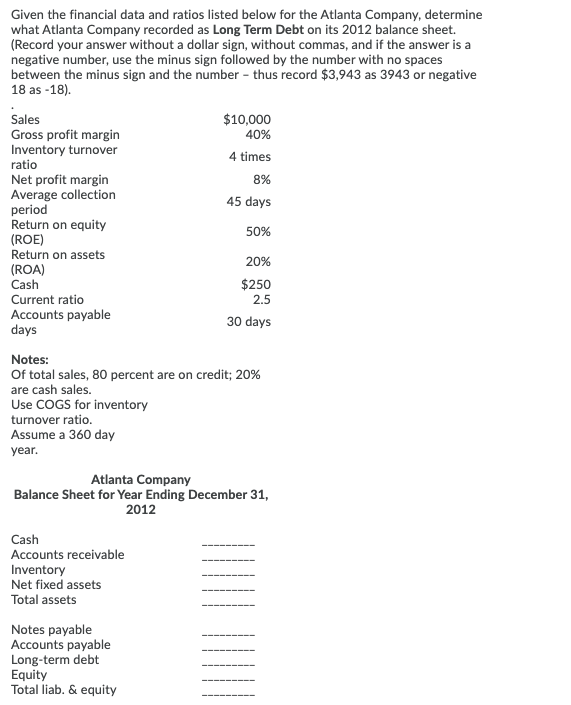

Question: Sales 8% Given the financial data and ratios listed below for the Atlanta Company, determine what Atlanta Company recorded as Long Term Debt on its

Sales 8% Given the financial data and ratios listed below for the Atlanta Company, determine what Atlanta Company recorded as Long Term Debt on its 2012 balance sheet. (Record your answer without a dollar sign, without commas, and if the answer is a negative number, use the minus sign followed by the number with no spaces between the minus sign and the number - thus record $3,943 as 3943 or negative 18 as - 18). $10,000 Gross profit margin 40% Inventory turnover 4 times ratio Net profit margin Average collection 45 days period Return on equity 50% (ROE) Return on assets 20% (ROA) Cash $250 Current ratio 2.5 Accounts payable 30 days days Notes: Of total sales, 80 percent are on credit; 20% are cash sales. Use COGS for inventory turnover ratio. Assume a 360 day year. Atlanta Company Balance Sheet for Year Ending December 31, 2012 Cash Accounts receivable Inventory Net fixed assets Total assets Notes payable Accounts payable Long-term debt Equity Total liab. & equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts