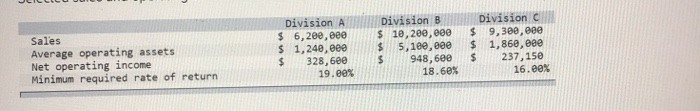

Question: Sales Average operating assets Net operating income Minimum required rate of return Division A $ 6, 2ee, eee $ 1,240,000 $ 328,600 19.00% Division B

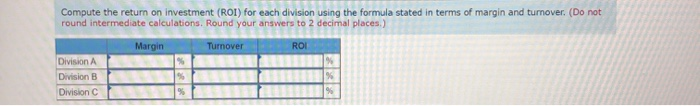

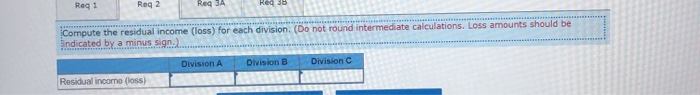

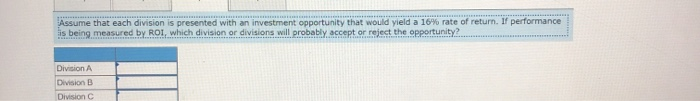

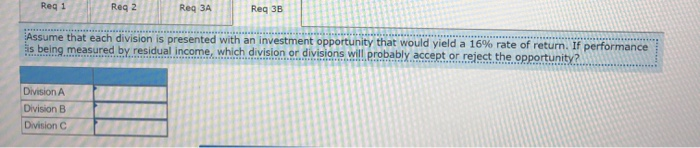

Sales Average operating assets Net operating income Minimum required rate of return Division A $ 6, 2ee, eee $ 1,240,000 $ 328,600 19.00% Division B $ 10, 200, eee 5,1ee, eee 948,600 18.68% $ $ Division C $ 9,380, eee $ 1,860, 880 $ 237,150 16.ee% Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Margin Turnover ROI Division Division B Division Req: Reg 2 Reg 3A Red 3B Compute the residual income (loss) for each division. (Do not round intermediate calculations. Loss amounts should be Sindicated by a minus sign.) Division A Division B Division Residual incomo loss) Assume that each division is presented with an investment opportunity that would yield a 16% rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity Division A Division B Division Reg 1 Reg 2 Reg 34 Reg 3B Assume that each division is presented with an investment opportunity that would yield a 16% rate of return. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Division A Division B Division C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts