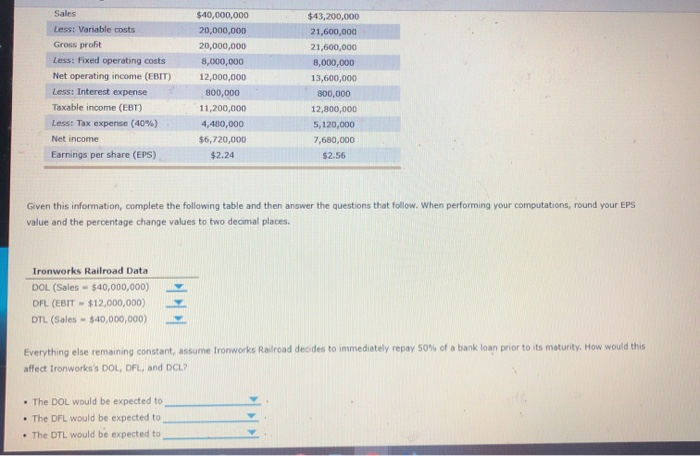

Question: Sales Less: Variable costs Gross profit Less: Fixed operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EBT) Less: Tax expense (40%) Net

Sales Less: Variable costs Gross profit Less: Fixed operating costs Net operating income (EBIT) Less: Interest expense Taxable income (EBT) Less: Tax expense (40%) Net income Earnings per share (EPS) $40,000,000 20,000,000 20,000,000 8,000,000 12,000,000 800,000 11,200,000 4,480,000 $6,720,000 $2.24 $43,200,000 21,600,000 21,600,000 8,000,000 13,600,000 800,000 12,800,000 5,120,000 7,680,000 $2.56 Given this information, complete the following table and then answer the questions that follow. When performing your computations, round your EPS value and the percentage change values to two decimal places. Ironworks Railroad Data DOL (Sales - $40,000,000) DFL (EBIT - $12,000,000) DTL (Sales - $40,000,000) Everything else remaining constant, assume Ironworks Railroad decides to immediately repay 50% of a bank loan prior to its maturity. How would this affect Ironworks's DOL, DFL, and DCL? The DOL would be expected to The DFL would be expected to The DTL would be expected to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts