Question: Sales Mix and Break even analysis & Operating Leverage Sales mix and break-even analysis Michael Company has fixed costs of $611,320. The unit selling price,

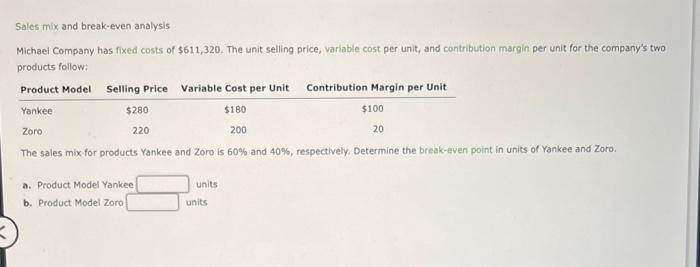

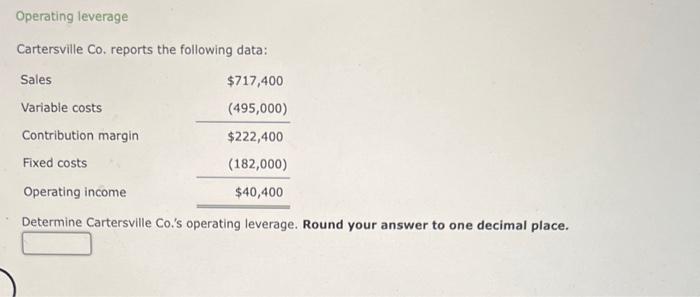

Sales mix and break-even analysis Michael Company has fixed costs of $611,320. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: The sales mix for products Yankee and Zoro is 60% and 40%, respectively, Determine the break-even point in units of Yankee and Zoro. a. Product Model Yankee b. Product Model Zoro units Operating leverage Cartersville Co. reports the following data: Determine Cartersville Co.'s operating leverage. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts