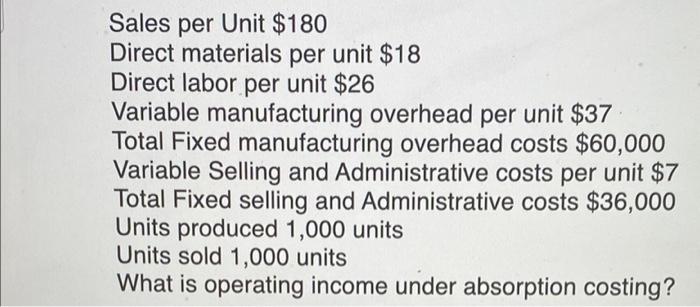

Question: Sales per Unit $180 Direct materials per unit $18 Direct labor per unit $26 Variable manufacturing overhead per unit $37 Total Fixed manufacturing overhead costs

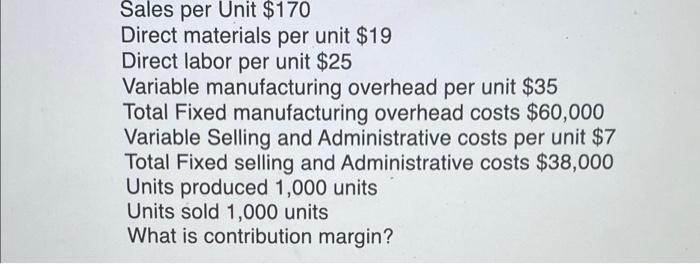

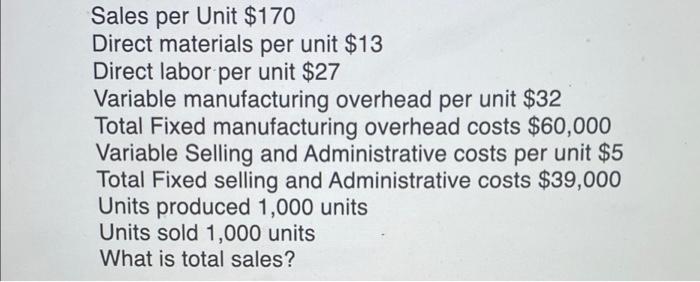

Sales per Unit $180 Direct materials per unit $18 Direct labor per unit $26 Variable manufacturing overhead per unit $37 Total Fixed manufacturing overhead costs $60,000 Variable Selling and Administrative costs per unit $7 Total Fixed selling and Administrative costs $36,000 Units produced 1,000 units Units sold 1,000 units What is operating income under absorption costing? Sales per Unit $170 Direct materials per unit $19 Direct labor per unit $25 Variable manufacturing overhead per unit $35 Total Fixed manufacturing overhead costs $60,000 Variable Selling and Administrative costs per unit $7 Total Fixed selling and Administrative costs $38,000 Units produced 1,000 units Units sold 1,000 units What is contribution margin? Sales per Unit $170 Direct materials per unit $13 Direct labor per unit $27 Variable manufacturing overhead per unit $32 Total Fixed manufacturing overhead costs $60,000 Variable Selling and Administrative costs per unit $5 Total Fixed selling and Administrative costs $39,000 Units produced 1,000 units Units sold 1,000 units What is total sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts