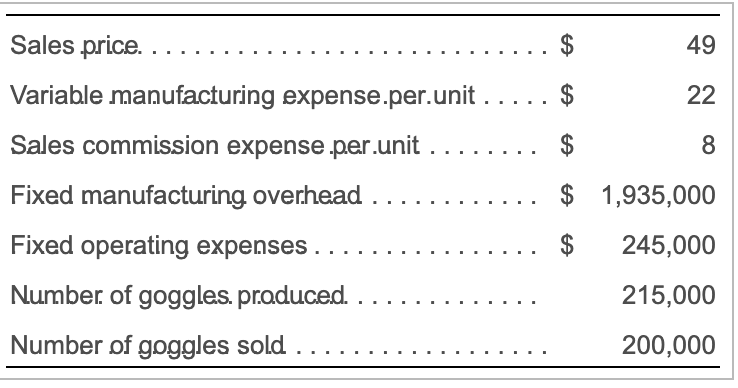

Question: Sales price.. . . 49 Variable manufacturing expense.per.unit $ 22 Sales commission expense per.unit . . . . $ 8 Fixed manufacturing overhead. ... $

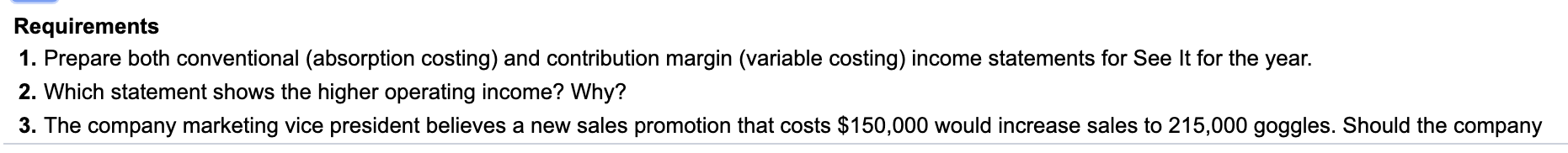

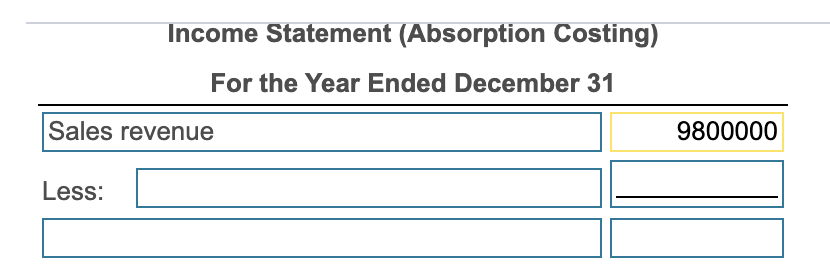

Sales price.. . . 49 Variable manufacturing expense.per.unit $ 22 Sales commission expense per.unit . . . . $ 8 Fixed manufacturing overhead. ... $ 1,935,000 $ 245,000 Fixed operating expenses Number of goggles. produced. . . 215,000 Number of goggles sold. 200,000 Requirements 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for See It for the year. 2. Which statement shows the higher operating income? Why? 3. The company marketing vice president believes a new sales promotion that costs $150,000 would increase sales to 215,000 goggles. Should the company Requirement 1. Prepare both conventional (absorption costing) and contribution margin (variable costing) income statements for See It for the year. Begin with the conventional (absorption costing) income statement. See It Income Statement (Absorption Costing) Income Statement (Absorption Costing) For the Year Ended December 31 Sales revenue 9800000 Less: Operating expenses Less

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts