Question: Sales price Unit variable product cost Labor cost Variable overhead Total fixed product cost Unit variable period cost Total fixed period cost 2019 2019 Produce

| Sales price | |||

| Unit variable product cost | |||

| Labor cost | |||

| Variable overhead | |||

| Total fixed product cost | |||

| Unit variable period cost | |||

| Total fixed period cost | |||

| 2019 | 2019 | ||

| Produce | |||

| Sell | |||

| Absorption Costing | Variable Costing | ||

| Sales | Sales | ||

| COGS | COGS | ||

| Variable COGS | Variable COGS | ||

| Fixed product costs | Less: Ending inventory | ||

| Total costs | Manufacturing margin | ||

| Less: Ending inventory | Less: Variable selling | ||

| units*unit product cost | Contribution margin | ||

| COGS | Less: Fixed costs | ||

| Gross profit | Manufacturing | ||

| Less: | Administrative | ||

| Selling expense | Total fixed | ||

| Administrative expense | Net income | ||

| Net income |

Please help with filling out the excel

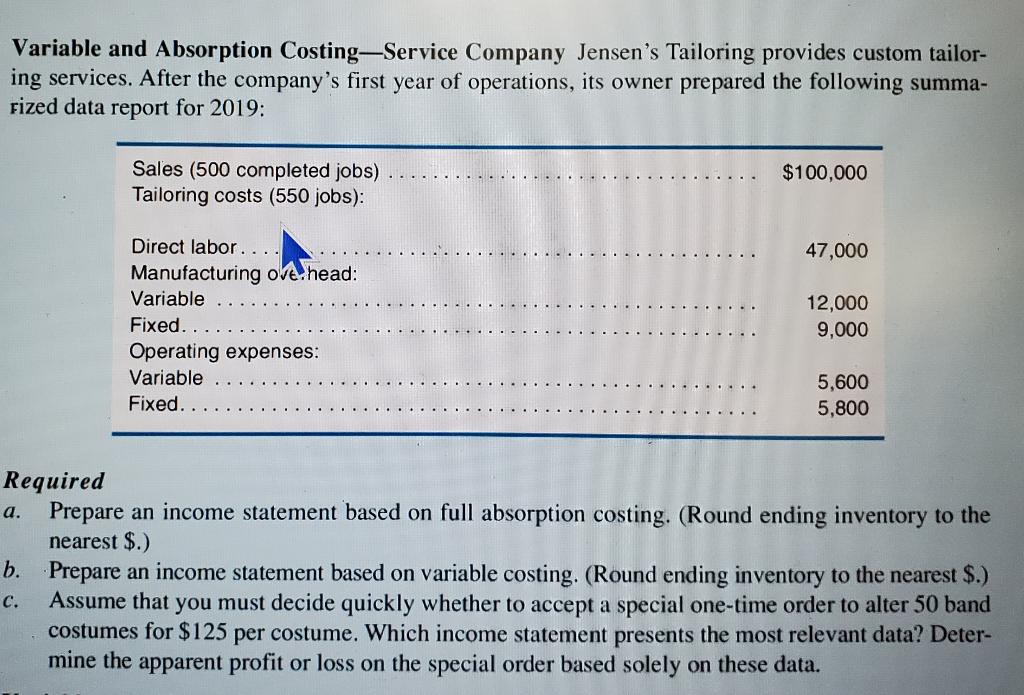

Variable and Absorption Costing-Service Company Jensen's Tailoring provides custom tailor- ing services. After the company's first year of operations, its owner prepared the following summa- rized data report for 2019: $100,000 Sales (500 completed jobs) Tailoring costs (550 jobs): 47,000 Direct labor.... Manufacturing ove.head: Variable Fixed... Operating expenses: Variable Fixed. 12,000 9,000 5,600 5,800 Required a. Prepare an income statement based on full absorption costing. (Round ending inventory to the nearest $.) b. Prepare an income statement based on variable costing. (Round ending inventory to the nearest $.) c. Assume that you must decide quickly whether to accept a special one-time order to alter 50 band costumes for $125 per costume. Which income statement presents the most relevant data? Deter- mine the apparent profit or loss on the special order based solely on these data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts