Question: Sales ( recieved in cash ) :$ 2 0 0 , 0 0 0 for december Raw materials purchases ( paid with cash ) :

Salesrecieved in cash:$ for december

Raw materials purchases paid with cash: $ for december

Factory payrollpaid with cash: $ for december

Indirect labor: $ for december

Other overhead: $ for december

Indirect materials: $ for december

Raw materials for december

Work in process for december

Finished goods for december

November raw materials

November work in process

November finished good

Predetermined overhead rate based on direct labor cost:

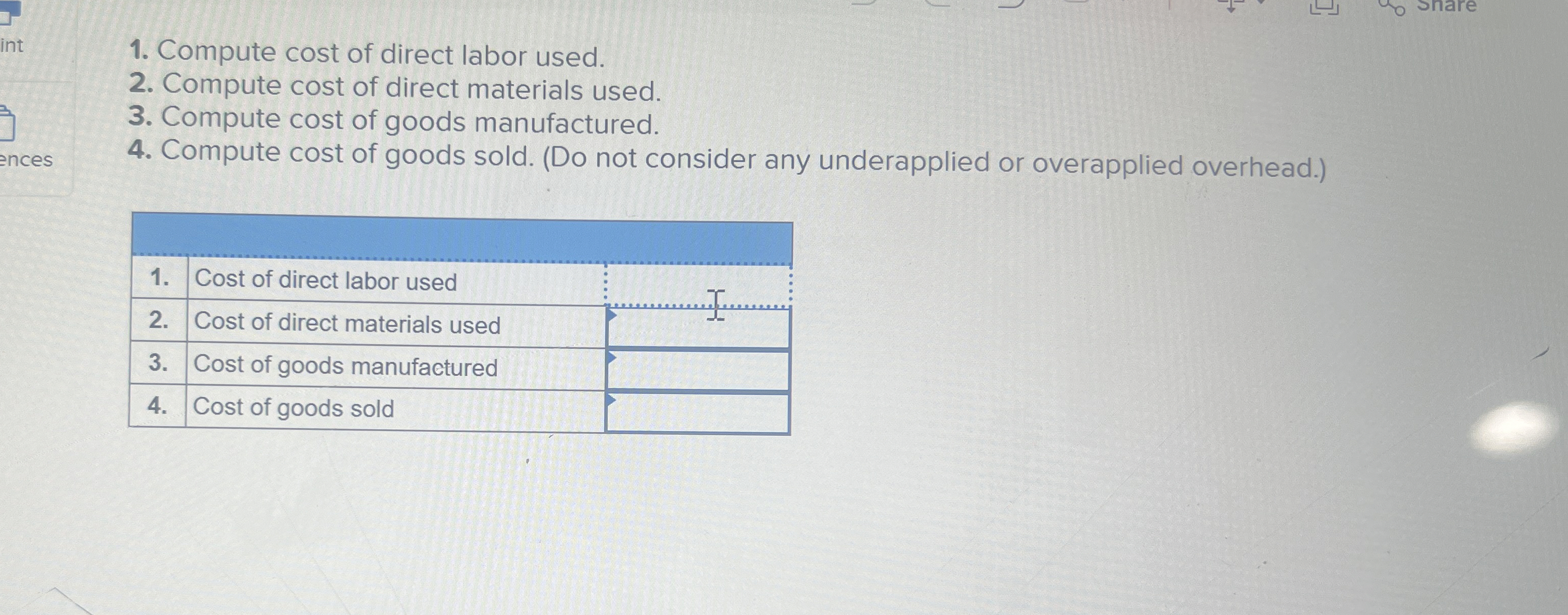

Compute cost of direct labor used.

Compute cost of direct materials used.

Compute cost of goods manufactured.

Compute cost of goods sold. Do not consider any underapplied or overapplied overhead.

tableCost of direct labor used,Cost of direct materials used,Cost of goods manufactured,Cost of goods sold,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock