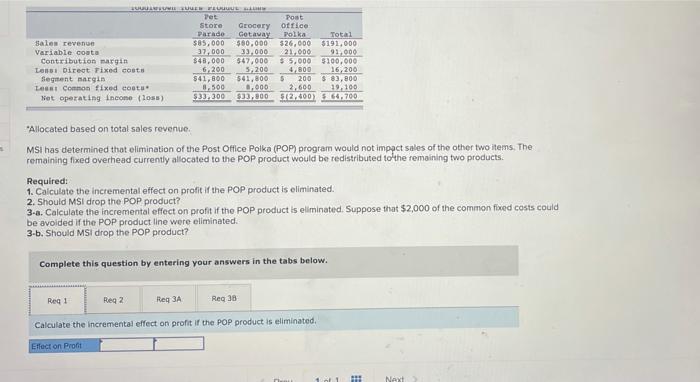

Question: Sales revenue Variable coata Contribution margin Loni Direct Fixed costs Segment margin Last common fixed cout Net operating Income (108) Pet Store Parade $85,000 37,000

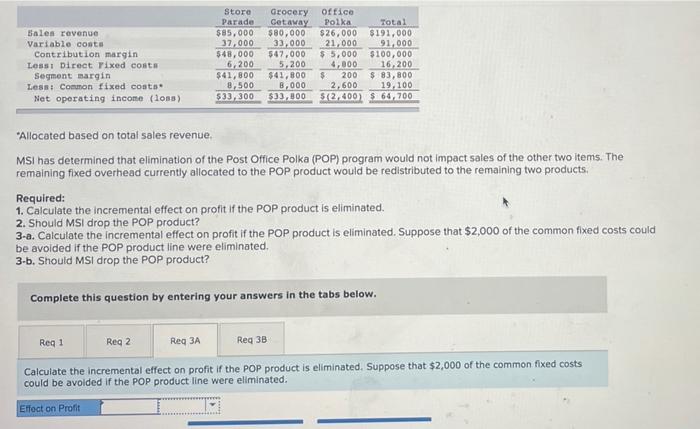

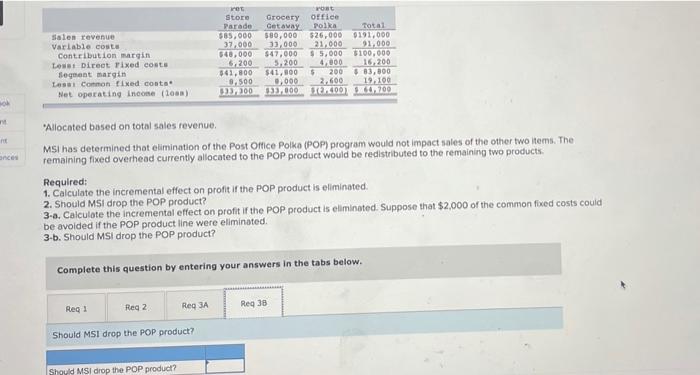

Sales revenue Variable coata Contribution margin Loni Direct Fixed costs Segment margin Last common fixed cout Net operating Income (108) Pet Store Parade $85,000 37,000 $48.000 6200 541,600 8.500 $33,300 Grocery Getaway $80,000 233.000 547,000 3,200 $41,800 0.000 $3,000 Post ottice Polka Total $26.000 $191,000 21.000 91.000 $5,000 $100,000 4,800 16,200 5200 $ 83,800 2.600 19.100 $12,00) $ 64,700 "Allocated based on total sales revenue MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the other two items. The remaining fixed overhead currently allocated to the POP product would be redistributed to the remaining two products Required: 1. Calculate the incremental effect on profit if the POP product is eliminated. 2. Should MSI drop the POP product? 3-a. Calculate the incremental effect on profit if the POP product is eliminated. Suppose that $2,000 of the common fixed costs could be avoided if the POP product line were eliminated 3-b. Should MSI drop the POP product? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req3A Reg38 Calculate the incremental effect on profit if the POP product is eliminated Effect on Profit Next Bales revenue Variable costs Contribution margin Less Direct Tixed costs Segment margin Less: Common fixed costs Net operating income (loss) Store Parade $85,000 37,000 548,000 6,200 $41,800 8,500 $33,300 Grocery Getaway $80,000 33,000 547.000 5,200 $41,800 B,000 $33,800 office Polka Total $26,000 $191,000 21,000 91,000 $15,000 $100,000 4,000 16,200 $ 200 $ 83, 800 2.600 19.100 512,400) $64.700 "Allocated based on total sales revenue, MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the other two items. The remaining fixed overhead currently allocated to the POP product would be redistributed to the remaining two products. Required: 1. Calculate the incremental effect on profit if the POP product is eliminated. 2. Should MSI drop the POP product? 3-a. Calculate the incremental effect on profit if the POP product is eliminated. Suppose that $2,000 of the common fixed costs could be avoided if the POP product line were eliminated. 3-b. Should MSI drop the POP product? Complete this question by entering your answers in the tabs below. Regi Reg 2 Req 3A Reg 3B Calculate the incremental effect on profit if the POP product is eliminated. Suppose that $2,000 of the common fixed costs could be avoided if the POP product line were eliminated. Effect on Profit Salen revenue Variable cost Contribution margin Loss Direct Fixed costs Segment margin Last common fixed costs. Net operating incon (loan) Store Parade $85,000 37.000 540,000 5200 541.800 3,500 033200 Grocery Getaway 580,000 33,000 $47.000 5.200 $41,300 0,000 333,000 vost office Polka Total 526,000 0191.000 21.000 91.000 $5,000 3100,000 4.000 16,200 $ 200 $ 83,800 2.600 19.100 100) 9700 ances "Allocated based on total sales revenue. MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the other two items. The remaining fixed overhead currently allocated to the POP product would be redistributed to the remaining two products Required: 1. Calculate the incremental effect on profit if the POP product is eliminated. 2. Should MSI drop the POP product? 3.a. Calculate the incremental effect on profit if the POP product is eliminated. Suppose that $2,000 of the common fixed costs could be avoided if the POP product line were eliminated. 3-b. Should MSI drop the POP product? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg 3A Reg 38 Should MSI drop the POP product? Should MSI drop the POP product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts