Question: Sally, age 6 0 , is getting a divorce from her doctor husband AI , age 6 0 . As part of the divorce, Sally

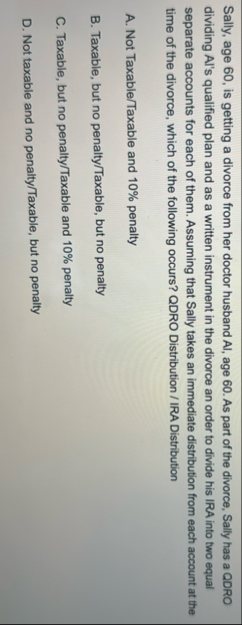

Sally, age is getting a divorce from her doctor husband AI age As part of the divorce, Sally has a QDRO dividing Al's qualified plan and as a written instrument in the divorce an order to divide his IRA into two equal separate accounts for each of them. Assuming that Sally takes an immediate distribution from each account at the time of the divorce, which of the following occurs? QDRO Distribution IRA Distribution

A Not TaxableTaxable and penalty

B Taxable, but no penaltyTaxable but no penalty

C Taxable, but no penaltyTaxable and penalty

D Not taxable and no penaltyTaxable but no penalty

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock