Question: Salmon Corp. currently has no debt but is considering adding $73 million in debt to its capital structure. The addition of debt to the capital

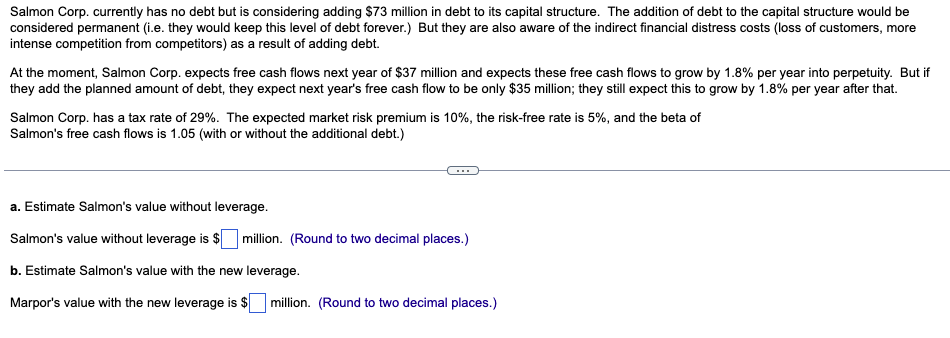

Salmon Corp. currently has no debt but is considering adding $73 million in debt to its capital structure. The addition of debt to the capital structure would be considered permanent (i.e. they would keep this level of debt forever.) But they are also aware of the indirect financial distress costs (loss of customers, more intense competition from competitors) as a result of adding debt. At the moment, Salmon Corp. expects free cash flows next year of $37 million and expects these free cash flows to grow by 1.8% per year into perpetuity. But if they add the planned amount of debt, they expect next year's free cash flow to be only $35 million; they still expect this to grow by 1.8% per year after that. Salmon Corp. has a tax rate of 29%. The expected market risk premium is 10%, the risk-free rate is 5%, and the beta of Salmon's free cash flows is 1.05 (with or without the additional debt.) a. Estimate Salmon's value without leverage. Salmon's value without leverage is $ million. (Round to two decimal places.) b. Estimate Salmon's value with the new leverage. Marpor's value with the new leverage is $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts