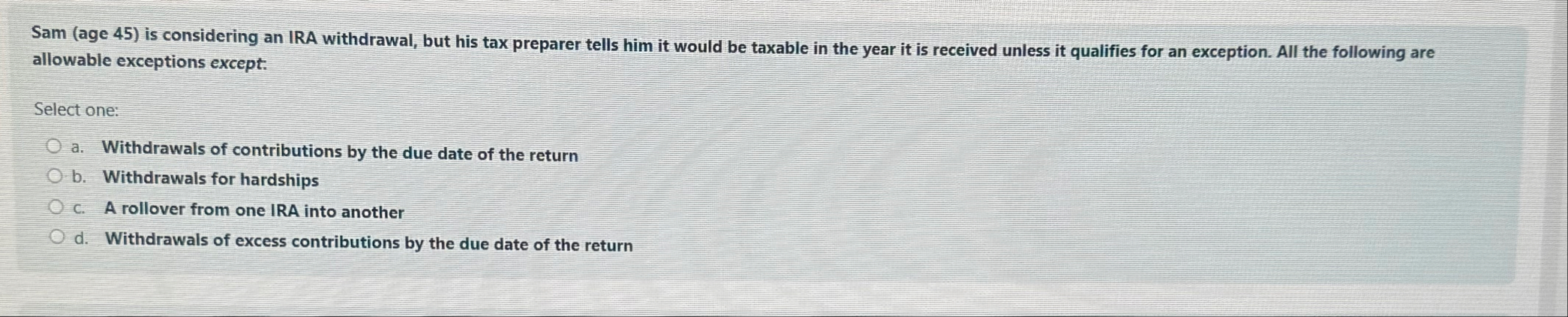

Question: Sam ( age 4 5 ) is considering an IRA withdrawal, but his tax preparer tells him it would be taxable in the year it

Sam age is considering an IRA withdrawal, but his tax preparer tells him it would be taxable in the year it is received unless it qualifies for an exception. All the following are allowable exceptions except.

Select one:

a Withdrawals of contributions by the due date of the return

b Withdrawals for hardships

c A rollover from one IRA into another

d Withdrawals of excess contributions by the due date of the return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock