Question: Sam has been retained as a management consultant by Hexagon Inc., a local specialty retailer, to analyse two proposed capital investment projects, Project X and

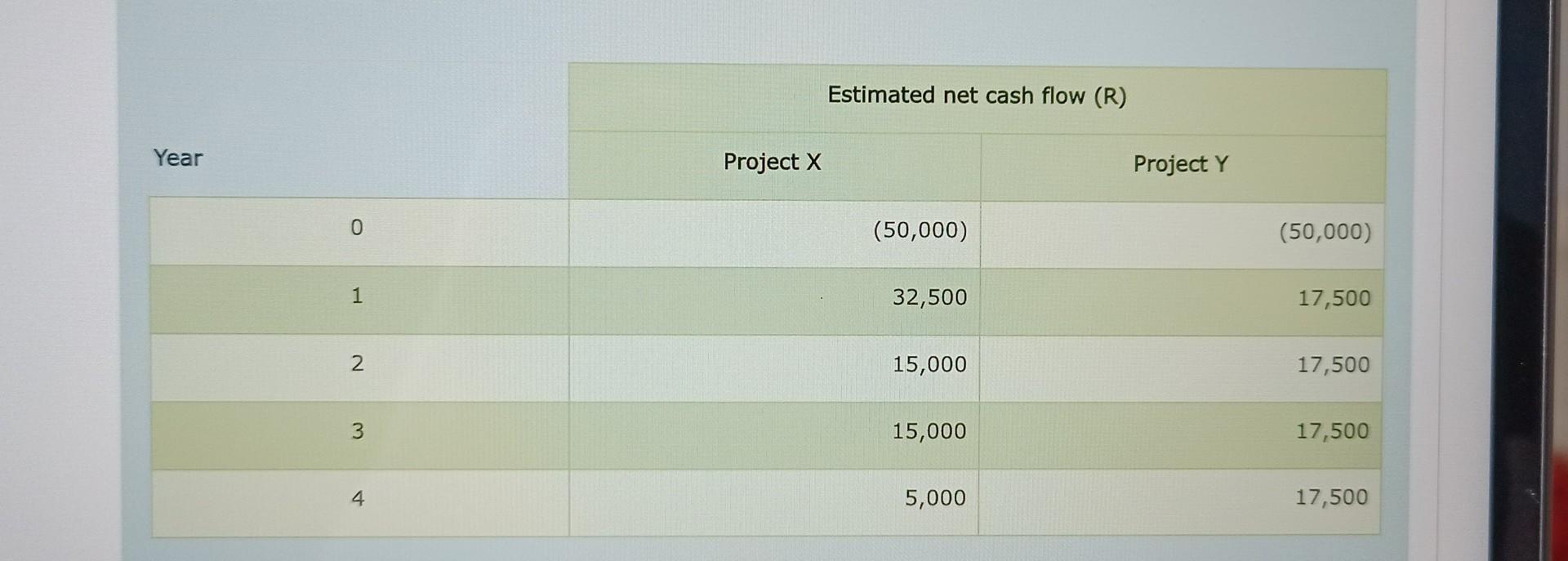

Sam has been retained as a management consultant by Hexagon Inc., a local specialty retailer, to analyse two proposed capital investment projects, Project X and Project Y. Project X is a sophisticated working capital and inventory control system based on a powerful personal computer called a system server and PC software specifically designed for inventory processing and control in the retailing business. Project Y is a similarly sophisticated working capital and inventory control system based upon a powerful personal computer and general PC software. Each project has a cost of R50,000 and the cost of capital for both projects is 12%. Projects expected new cash flows are as follows:

2.1 . How would you assess the working capital requirements for the seasonal industry in which you have been appointed as finance manager? Justify your answer with suitable examples. (15 marks)

2.2 Calculate the Net Present Value for both Projects X and Y, and assist Sam to suggest which project should be accepted.

Estimated net cash flow (R) Year Project X Project Y \begin{tabular}{rrrrr} \hline 0 & (50,000) \\ \hline 1 & 32,500 \\ \hline 3 & 17,500 \\ \hline 4 & 15,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts