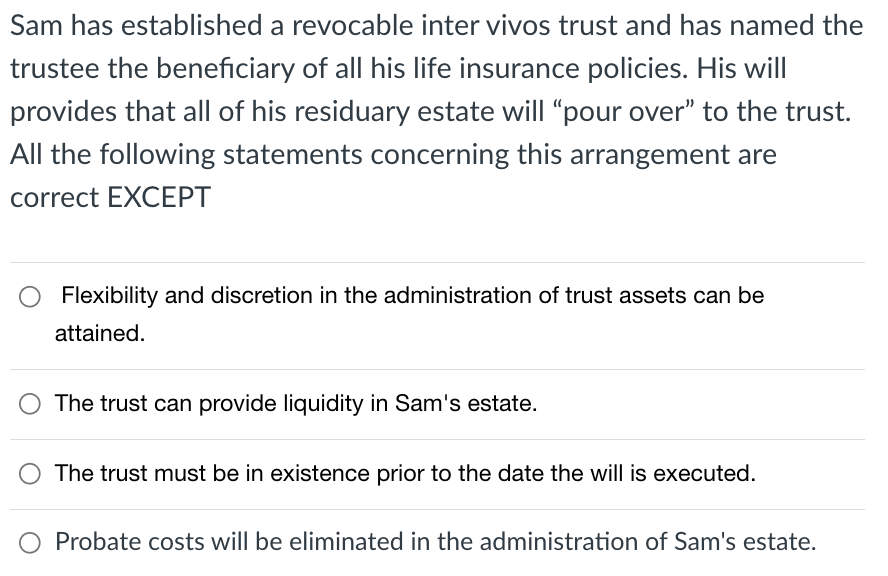

Question: Sam has established a revocable inter vivos trust and has named the trustee the beneficiary of all his life insurance policies. His will provides that

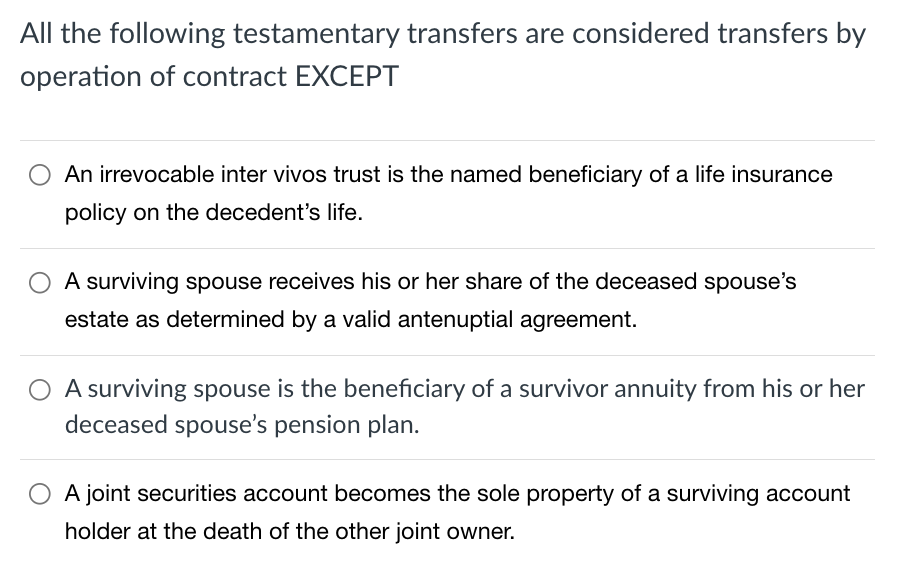

Sam has established a revocable inter vivos trust and has named the trustee the beneficiary of all his life insurance policies. His will provides that all of his residuary estate will "pour over" to the trust. All the following statements concerning this arrangement are correct EXCEPT Flexibility and discretion in the administration of trust assets can be attained. The trust can provide liquidity in Sam's estate. The trust must be in existence prior to the date the will is executed. Probate costs will be eliminated in the administration of Sam's estate. All the following testamentary transfers are considered transfers by operation of contract EXCEPT An irrevocable inter vivos trust is the named beneficiary of a life insurance policy on the decedent's life. A surviving spouse receives his or her share of the deceased spouse's estate as determined by a valid antenuptial agreement. A surviving spouse is the beneficiary of a survivor annuity from his or her deceased spouse's pension plan. A joint securities account becomes the sole property of a surviving account holder at the death of the other joint owner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts