Question: (Same case as question 3) Ximena is considering adding doggie desserts as a product line at her pet bakery. She has already purchased a doggie

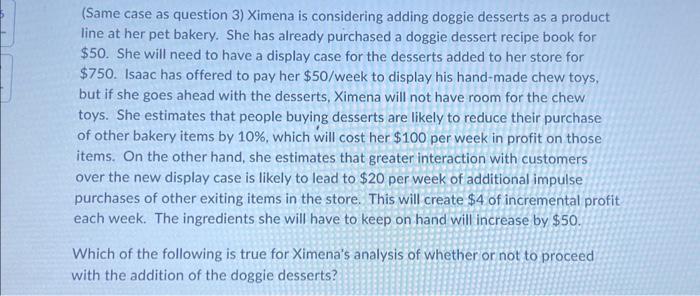

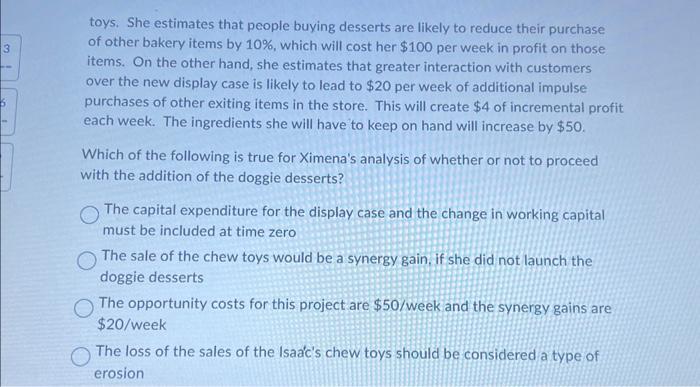

(Same case as question 3) Ximena is considering adding doggie desserts as a product line at her pet bakery. She has already purchased a doggie dessert recipe book for \$50. She will need to have a display case for the desserts added to her store for \$750. Isaac has offered to pay her $50 /week to display his hand-made chew toys, but if she goes ahead with the desserts, Ximena will not have room for the chew toys. She estimates that people buying desserts are likely to reduce their purchase of other bakery items by 10%, which will cost her $100 per week in profit on those items. On the other hand, she estimates that greater interaction with customers over the new display case is likely to lead to $20 per week of additional impulse purchases of other exiting items in the store. This will create $4 of incremental profit each week. The ingredients she will have to keep on hand will increase by $50. Which of the following is true for Ximena's analysis of whether or not to proceed with the addition of the doggie desserts? toys. She estimates that people buying desserts are likely to reduce their purchase of other bakery items by 10%, which will cost her $100 per week in profit on those items. On the other hand, she estimates that greater interaction with customers over the new display case is likely to lead to $20 per week of additional impulse purchases of other exiting items in the store. This will create $4 of incremental profit each week. The ingredients she will have to keep on hand will increase by $50. Which of the following is true for Ximena's analysis of whether or not to proceed with the addition of the doggie desserts? The capital expenditure for the display case and the change in working capital must be included at time zero The sale of the chew toys would be a synergy gain, if she did not launch the doggie desserts The opportunity costs for this project are $50/ week and the synergy gains are $20/ week The loss of the sales of the Isaa'c's chew toys should be considered a type of erosion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts