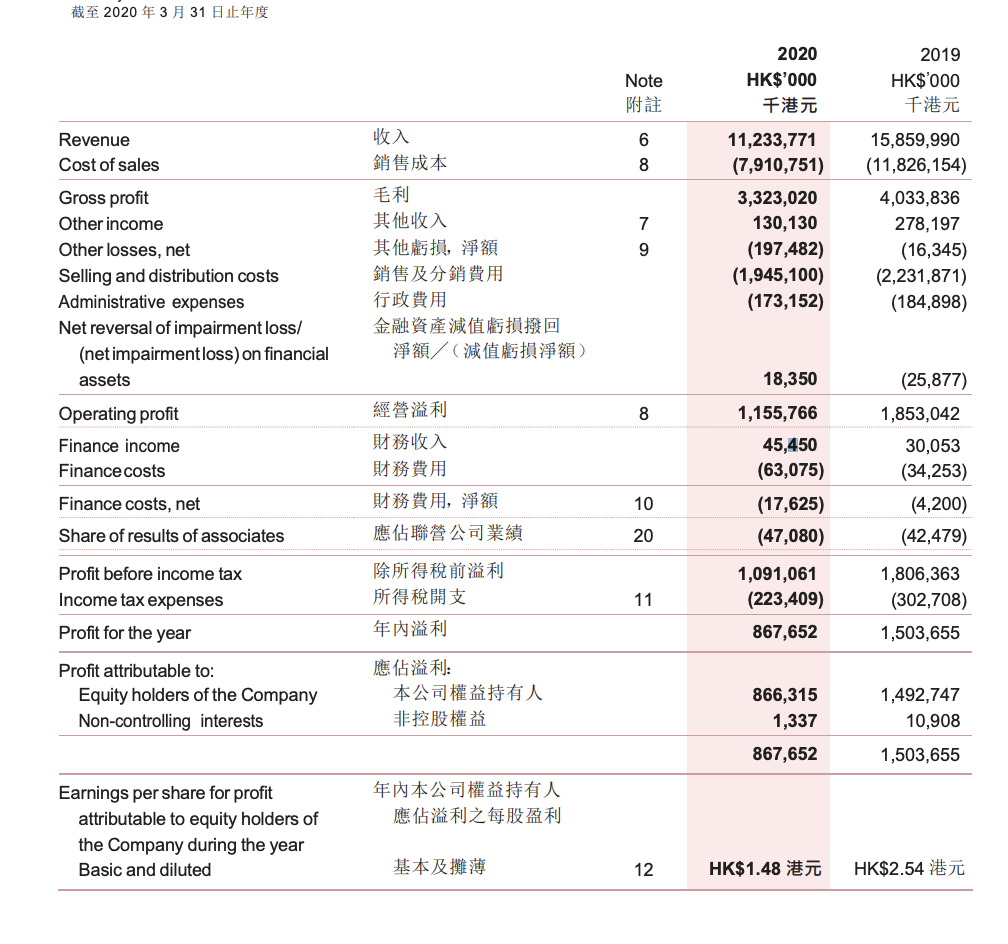

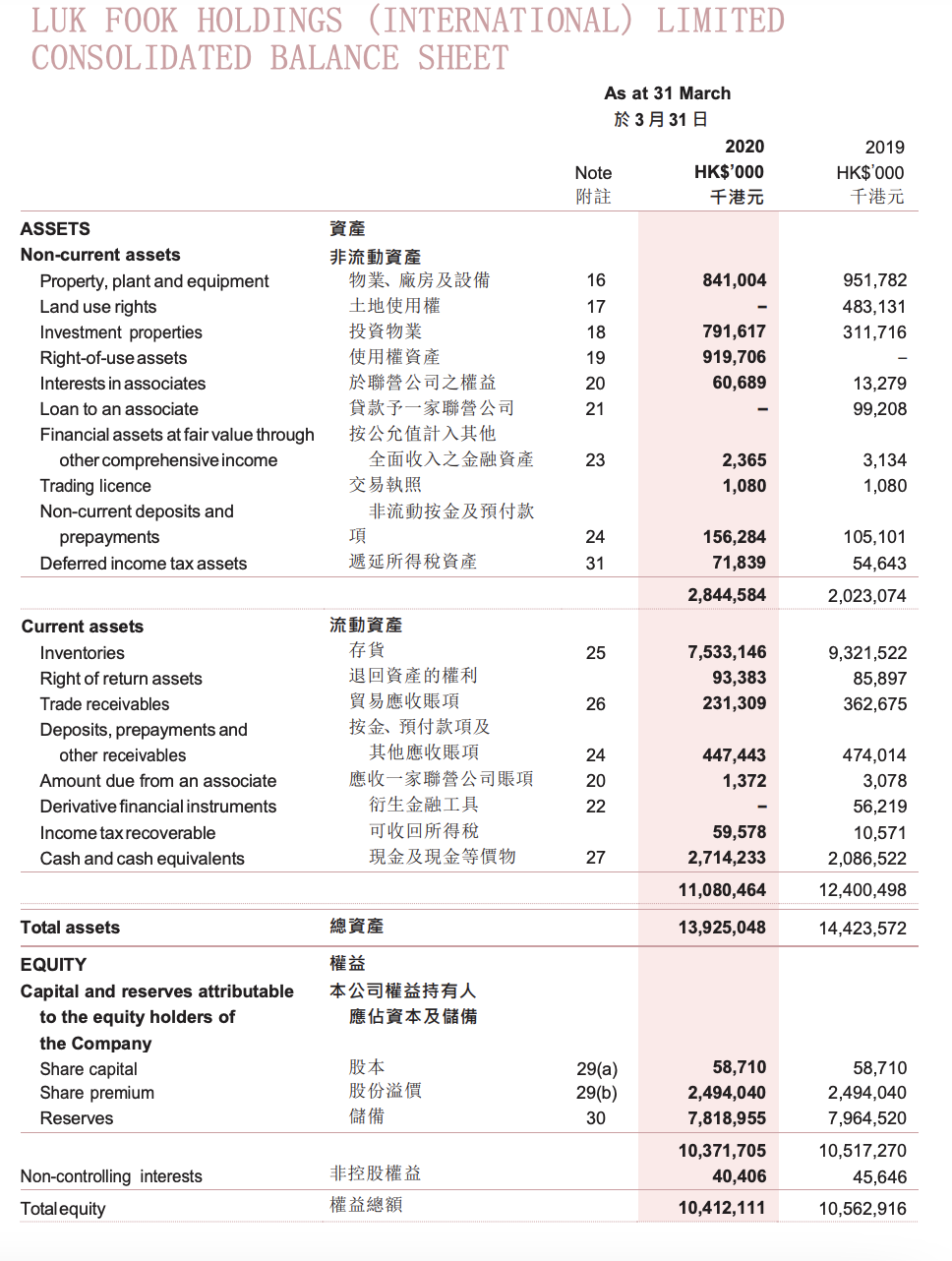

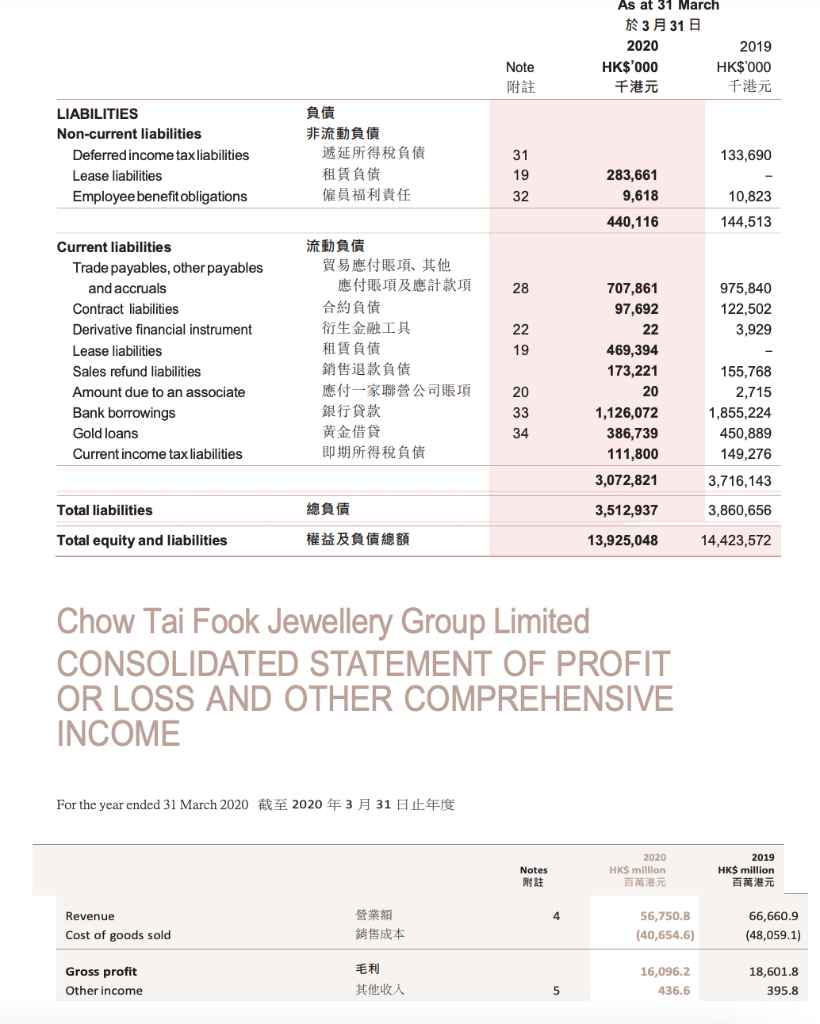

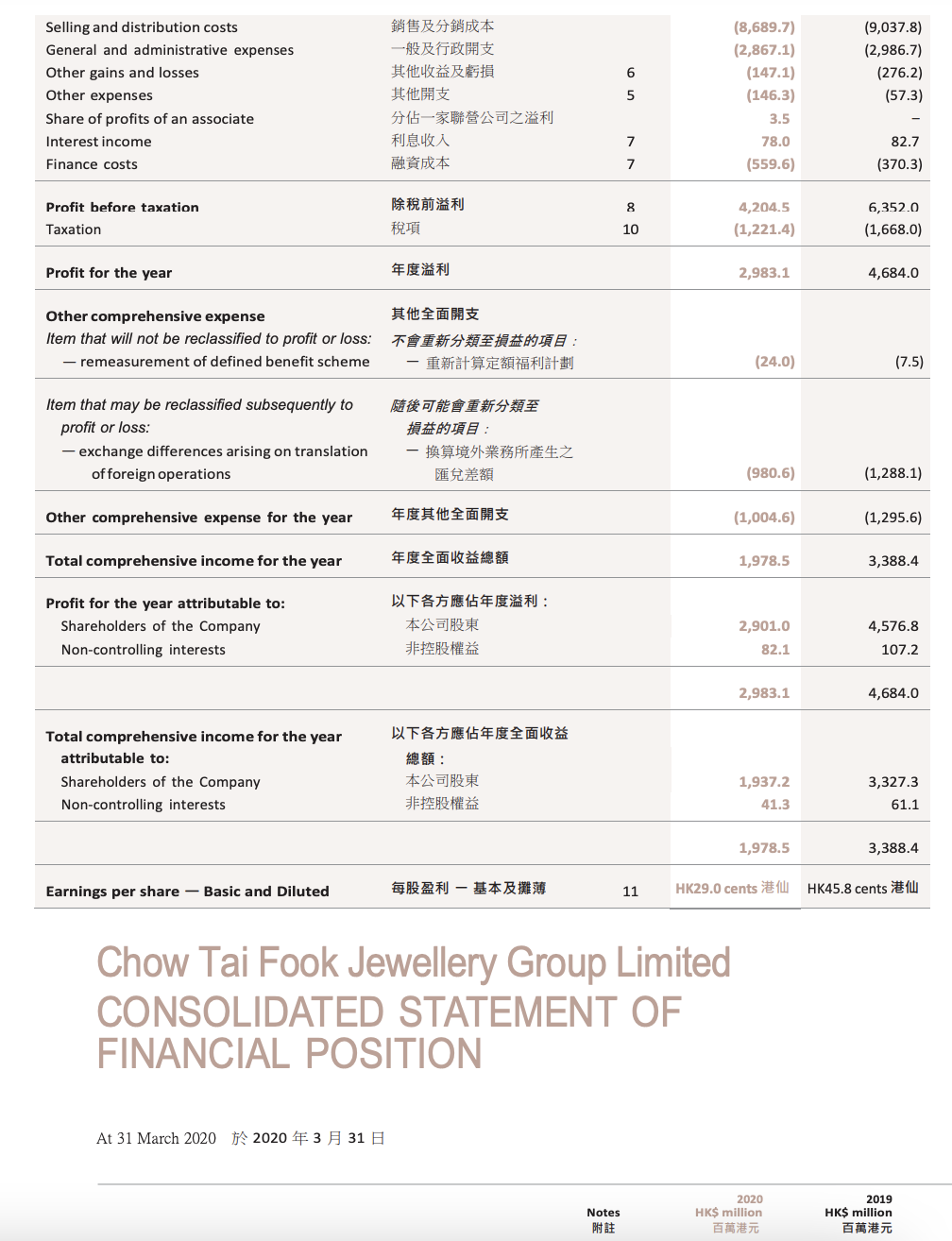

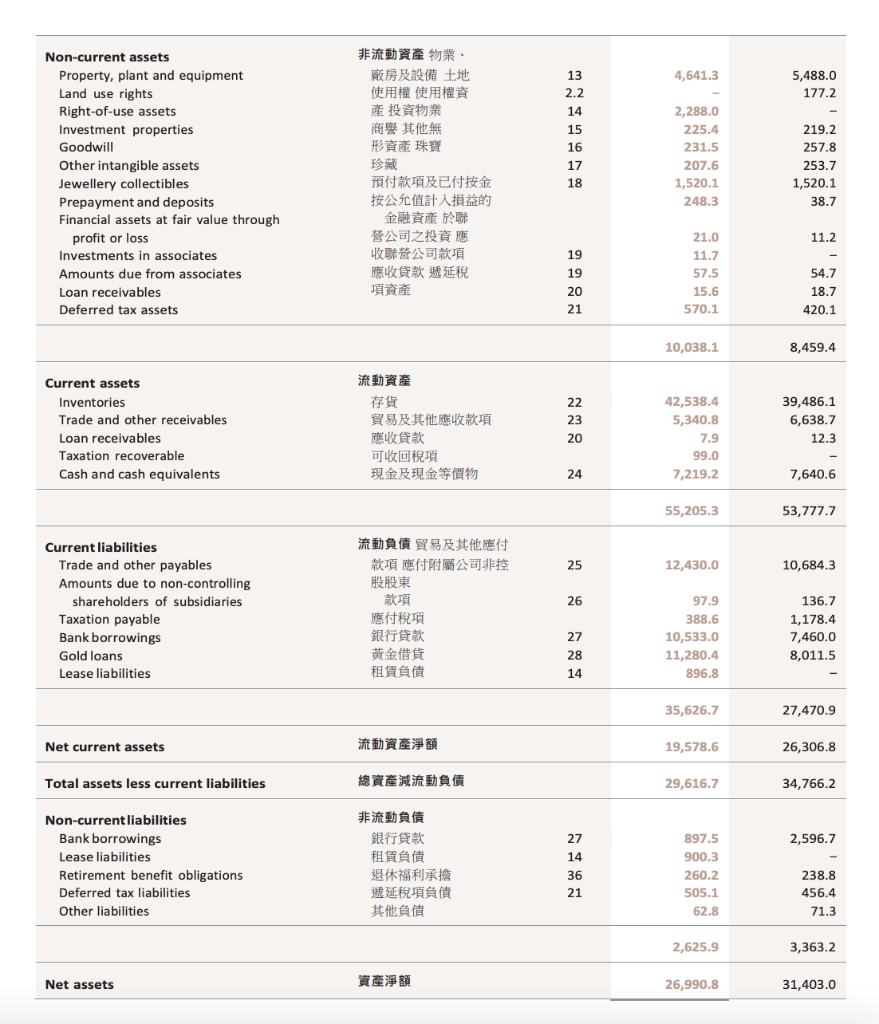

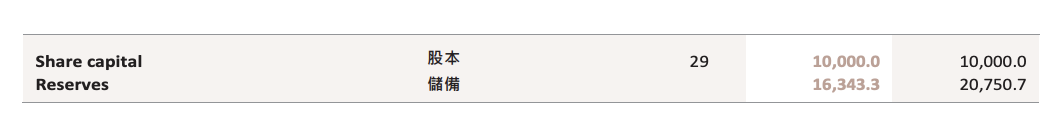

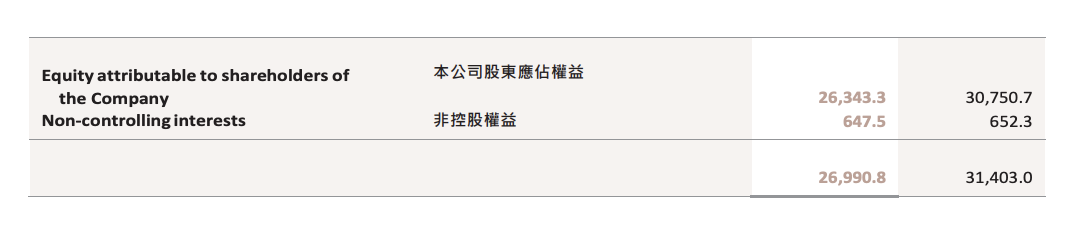

Question: $same company picture 1&2 Note: Average Total Equity = (Beginning balance of shareholders equity + Ending balance of shareholders equity) / 2 a) Perform vertical

$same company picture 1&2

Note: Average Total Equity = (Beginning balance of shareholders equity + Ending balance of shareholders equity) / 2

a) Perform vertical analysis for the two companies for the years of 2019 and 2020.

b) Perform ratio analysis for the two companies for the year ended 30 June 2020. The scope of analysis should include liquidity, profitability, and solvency. Please show the workings (with the equation) of the accounting ratios.

c) Recommend with reasons which company is considered to have better financial performance.

Don't worry about the Chinese words. They are just translations.

Don't worry about the Chinese words. They are just translations.

Don't worry about the Chinese words. They are just translations.

Don't worry about the Chinese words. They are just translations.

Don't worry about the Chinese words. They are just translations.

Don't worry about the Chinese words. They are just translations.

As at 31 March 331 2020 2019 HK$"000 HK$"000 Note LIABILITIES Non-current liabilities Deferred income tax liabilities Lease liabilities Employee benefit obligations 133,690 31 19 283,661 9,618 32 10,823 440,116 144,513 28 975,840 122,502 3,929 Current liabilities Trade payables, other payables and accruals Contract liabilities Derivative financial instrument Lease liabilities Sales refund liabilities Amount due to an associate Bank borrowings Gold loans Current income tax liabilities 22 19 707,861 97,692 22 469,394 173,221 20 1,126,072 386,739 111,800 3,072,821 20 33 34 155,768 2,715 1,855,224 450,889 149,276 3,716,143 Total liabilities 3,512,937 3,860,656 Total equity and liabilities 13,925,048 14,423,572 Chow Tai Fook Jewellery Group Limited CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the year ended 31 March 2020 2020331 Notes 2020 HK$ million 2019 HK$ million Revenue Cost of goods sold 56,750.8 (40,654.6) 66,660.9 (48,059.1) Gross profit Other income 16,096.2 436.6 18,601.8 395.8 5 Selling and distribution costs General and administrative expenses Other gains and losses Other expenses Share of profits of an associate Interest income Finance costs 6 (9,037.8) (2,986.7) (276.2) (57.3) (8,689.7) (2,867.1) (147.1) (146.3) 3.5 78.0 (559.6) 5 7 82.7 7 (370.3) 8 6,352.0 Profit before taxation Taxation 4,204.5 (1,221.4) 10 (1,668.0) Profit for the year 2,983.1 4,684.0 Other comprehensive expense Item that will not be reclassified to profit or loss: - remeasurement of defined benefit scheme : (24.0) (7.5) Item that may be reclassified subsequently to profit or loss: - exchange differences arising on translation of foreign operations : - (980.6) (1,288.1) Other comprehensive expense for the year (1,004.6) (1,295.6) Total comprehensive income for the year 1,978.5 3,388.4 Profit for the year attributable to: Shareholders of the Company Non-controlling interests : 2,901.0 82.1 4,576.8 107.2 2,983.1 4,684.0 Total comprehensive income for the year attributable to: Shareholders of the Company Non-controlling interests : 1,937.2 41.3 3,327.3 61.1 1,978.5 3,388.4 Earnings per share - Basic and Diluted - 11 HK29.0 cent HK45.8 cents Chow Tai Fook Jewellery Group Limited CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 31 March 2020 2020331 Notes 2020 HK$ million 2019 HK$ million 29 Share capital Reserves 10,000.0 16,343.3 10,000.0 20,750.7 Equity attributable to shareholders of the Company Non-controlling interests 26,343.3 647.5 30,750.7 652.3 26,990.8 31,403.0 As at 31 March 331 2020 2019 HK$"000 HK$"000 Note LIABILITIES Non-current liabilities Deferred income tax liabilities Lease liabilities Employee benefit obligations 133,690 31 19 283,661 9,618 32 10,823 440,116 144,513 28 975,840 122,502 3,929 Current liabilities Trade payables, other payables and accruals Contract liabilities Derivative financial instrument Lease liabilities Sales refund liabilities Amount due to an associate Bank borrowings Gold loans Current income tax liabilities 22 19 707,861 97,692 22 469,394 173,221 20 1,126,072 386,739 111,800 3,072,821 20 33 34 155,768 2,715 1,855,224 450,889 149,276 3,716,143 Total liabilities 3,512,937 3,860,656 Total equity and liabilities 13,925,048 14,423,572 Chow Tai Fook Jewellery Group Limited CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the year ended 31 March 2020 2020331 Notes 2020 HK$ million 2019 HK$ million Revenue Cost of goods sold 56,750.8 (40,654.6) 66,660.9 (48,059.1) Gross profit Other income 16,096.2 436.6 18,601.8 395.8 5 Selling and distribution costs General and administrative expenses Other gains and losses Other expenses Share of profits of an associate Interest income Finance costs 6 (9,037.8) (2,986.7) (276.2) (57.3) (8,689.7) (2,867.1) (147.1) (146.3) 3.5 78.0 (559.6) 5 7 82.7 7 (370.3) 8 6,352.0 Profit before taxation Taxation 4,204.5 (1,221.4) 10 (1,668.0) Profit for the year 2,983.1 4,684.0 Other comprehensive expense Item that will not be reclassified to profit or loss: - remeasurement of defined benefit scheme : (24.0) (7.5) Item that may be reclassified subsequently to profit or loss: - exchange differences arising on translation of foreign operations : - (980.6) (1,288.1) Other comprehensive expense for the year (1,004.6) (1,295.6) Total comprehensive income for the year 1,978.5 3,388.4 Profit for the year attributable to: Shareholders of the Company Non-controlling interests : 2,901.0 82.1 4,576.8 107.2 2,983.1 4,684.0 Total comprehensive income for the year attributable to: Shareholders of the Company Non-controlling interests : 1,937.2 41.3 3,327.3 61.1 1,978.5 3,388.4 Earnings per share - Basic and Diluted - 11 HK29.0 cent HK45.8 cents Chow Tai Fook Jewellery Group Limited CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 31 March 2020 2020331 Notes 2020 HK$ million 2019 HK$ million 29 Share capital Reserves 10,000.0 16,343.3 10,000.0 20,750.7 Equity attributable to shareholders of the Company Non-controlling interests 26,343.3 647.5 30,750.7 652.3 26,990.8 31,403.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts