Question: same question, its two parts On that date, the burik statement indicatrd a bulance of 51091826 1. Depouts in tanstjuly tl anogeced to 14292M 2.

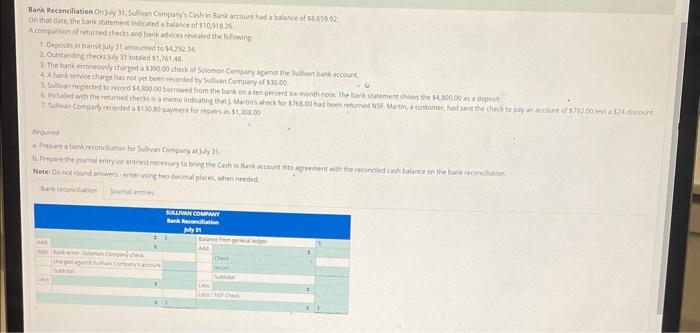

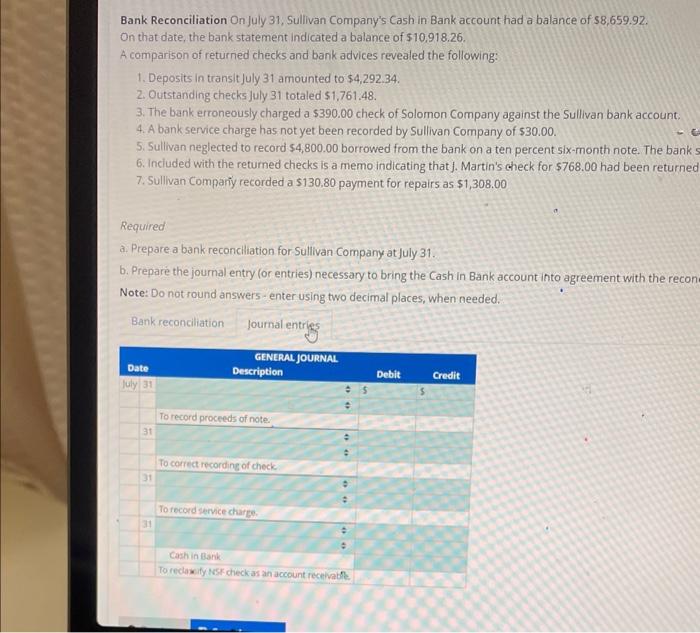

On that date, the burik statement indicatrd a bulance of 51091826 1. Depouts in tanstjuly tl anogeced to 14292M 2. oustatding chechs Juig 31 totibd 17 761,48 4. A tain serice dharge thas notyet been recoid ted by Sill wan Compiny of 530.00 . Acquined Bank Reconciliation On July 31, Sullivan Company's Cash in Bank account had a balance of $8,659.92. On that date, the bank statement indicated a balance of $10,918.26. A comparison of returned checks and bank advices revealed the following: 1. Deposits in transit July 31 amounted to $4,292.34. 2. Outstanding checks july 31 totaled $1,761.48. 3. The bank erroneously charged a $390.00 check of Solomon Company against the Sullivan bank account. 4. A bankservice charge has not yet been recorded by Sullivan Company of $30.00. 5. Sullivan neglected to record $4,800.00 borrowed from the bank on a ten percent six-month note. The bank 5 6. Inciuded with the retumed checks is a memo indicating that ). Martin's check for $768.00 had been returned 7. Sullivan Compariy recorded a $130,80 payment for repairs as $1,308.00 Required a. Prepare a bank reconciliation for-Sullivan Company at july 31. b. Prepare the journal entry (or entries) necessary to bring the Cash In Bank account into agreement with the recon Note: Do not round answers - enter using two decimal places, when needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts