Question: same question just does not fit in one pic ABC Co., makes and markets cars and toothpaste. It is considering a new factory to manufacture

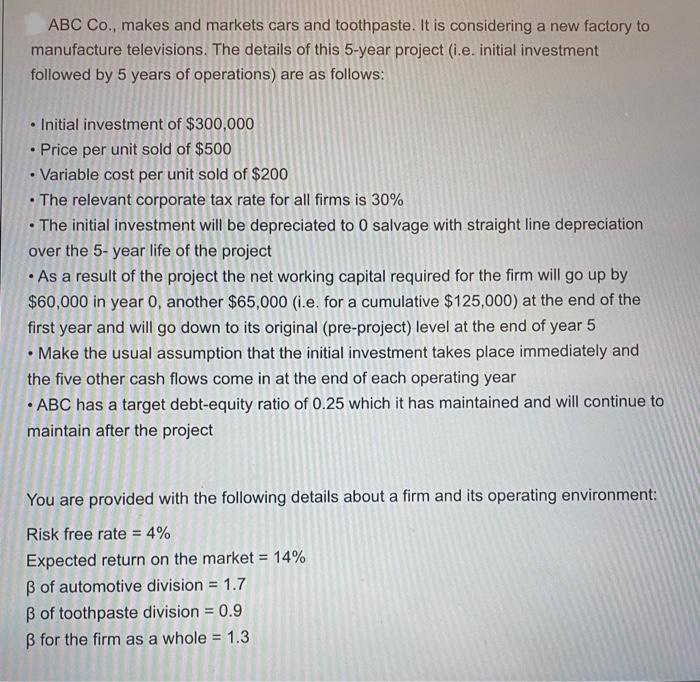

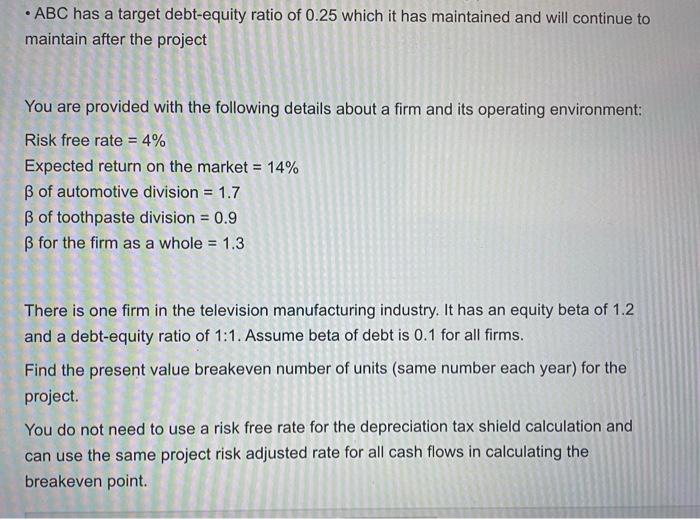

ABC Co., makes and markets cars and toothpaste. It is considering a new factory to manufacture televisions. The details of this 5-year project (i.e. initial investment followed by 5 years of operations) are as follows: Initial investment of $300,000 Price per unit sold of $500 . Variable cost per unit sold of $200 . The relevant corporate tax rate for all firms is 30% . The initial investment will be depreciated to 0 salvage with straight line depreciation over the 5-year life of the project . As a result of the project the net working capital required for the firm will go up by $60,000 in year 0, another $65,000 (i.e. for a cumulative $125,000) at the end of the first year and will go down to its original (pre-project) level at the end of year 5 Make the usual assumption that the initial investment takes place immediately and the five other cash flows come in at the end of each operating year ABC has a target debt-equity ratio of 0.25 which it has maintained and will continue to maintain after the project You are provided with the following details about a firm and its operating environment: Risk free rate = 4% Expected return on the market = 14% of automotive division = 1.7 of toothpaste division = 0.9 for the firm as a whole = 1.3 ABC has a target debt-equity ratio of 0.25 which it has maintained and will continue to maintain after the project You are provided with the following details about a firm and its operating environment: Risk free rate = 4% Expected return on the market = 14% of automotive division = 1.7 of toothpaste division = 0.9 for the firm as a whole = 1.3 There is one firm in the television manufacturing industry. It has an equity beta of 1.2 and a debt-equity ratio of 1:1. Assume beta of debt is 0.1 for all firms. Find the present value breakeven number of units (same number each year) for the project. You do not need to use a risk free rate for the depreciation tax shield calculation and can use the same project risk adjusted rate for all cash flows in calculating the breakeven point. ABC Co., makes and markets cars and toothpaste. It is considering a new factory to manufacture televisions. The details of this 5-year project (i.e. initial investment followed by 5 years of operations) are as follows: Initial investment of $300,000 Price per unit sold of $500 . Variable cost per unit sold of $200 . The relevant corporate tax rate for all firms is 30% . The initial investment will be depreciated to 0 salvage with straight line depreciation over the 5-year life of the project . As a result of the project the net working capital required for the firm will go up by $60,000 in year 0, another $65,000 (i.e. for a cumulative $125,000) at the end of the first year and will go down to its original (pre-project) level at the end of year 5 Make the usual assumption that the initial investment takes place immediately and the five other cash flows come in at the end of each operating year ABC has a target debt-equity ratio of 0.25 which it has maintained and will continue to maintain after the project You are provided with the following details about a firm and its operating environment: Risk free rate = 4% Expected return on the market = 14% of automotive division = 1.7 of toothpaste division = 0.9 for the firm as a whole = 1.3 ABC has a target debt-equity ratio of 0.25 which it has maintained and will continue to maintain after the project You are provided with the following details about a firm and its operating environment: Risk free rate = 4% Expected return on the market = 14% of automotive division = 1.7 of toothpaste division = 0.9 for the firm as a whole = 1.3 There is one firm in the television manufacturing industry. It has an equity beta of 1.2 and a debt-equity ratio of 1:1. Assume beta of debt is 0.1 for all firms. Find the present value breakeven number of units (same number each year) for the project. You do not need to use a risk free rate for the depreciation tax shield calculation and can use the same project risk adjusted rate for all cash flows in calculating the breakeven point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts