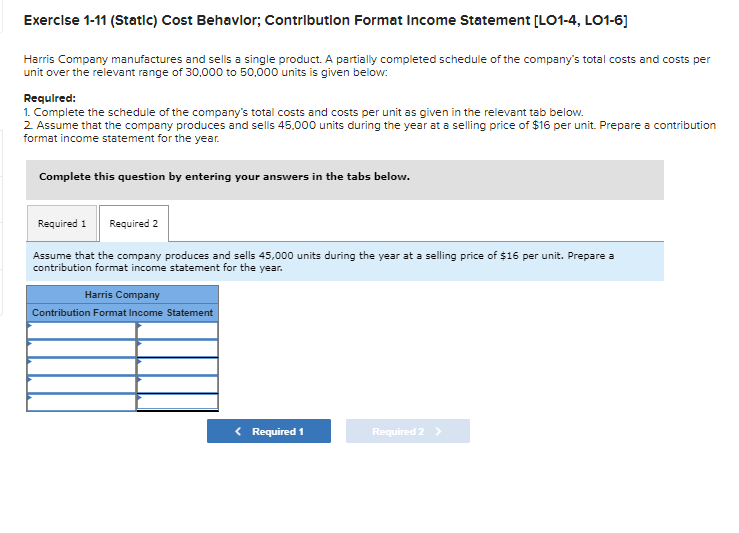

Question: Same question just showing you drop down options. Exercise 1-11 (Static) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and sells a

![Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717a3df36a21_5266717a3de9b76b.jpg)

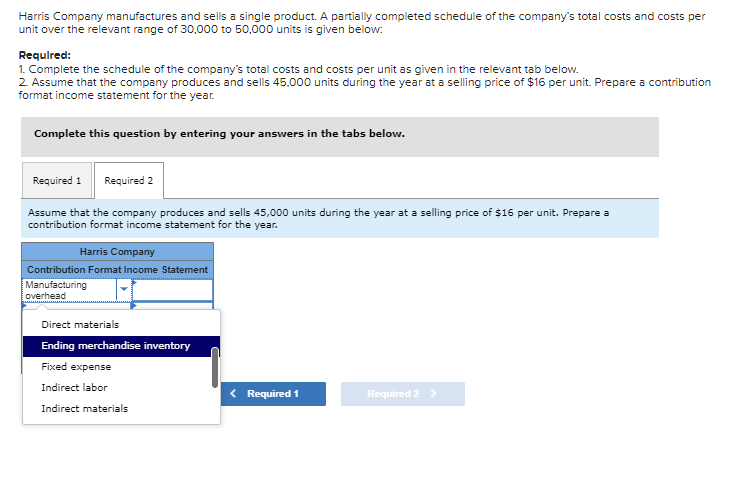

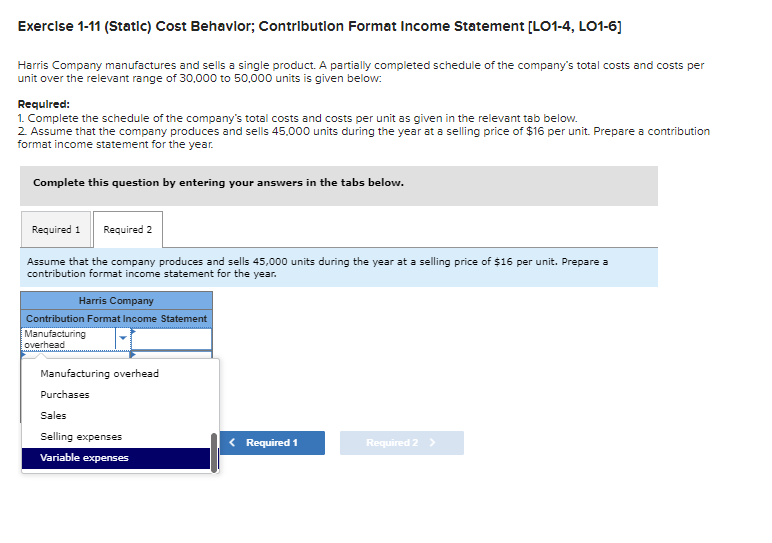

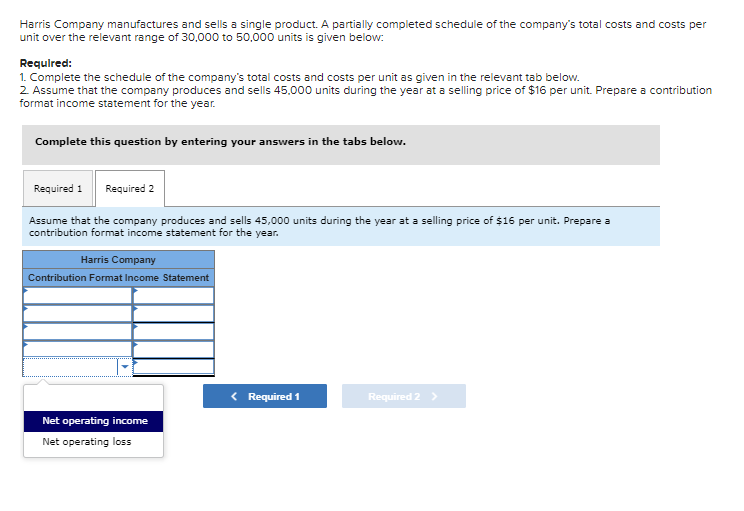

Same question just showing you drop down options.

Exercise 1-11 (Static) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45.000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Exercise 1-11 (Static) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Administrative expenses Beginning merchandise inventory Cost of goods sold Direct labor Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Manufacturing overhead Direct materials Ending merchandise inventory Fixed expense Indirect labor Required 2 > Indirect materials Variable expenses Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Net operating income Net operating loss Exercise 1-11 (Static) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45.000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Exercise 1-11 (Static) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Administrative expenses Beginning merchandise inventory Cost of goods sold Direct labor Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Manufacturing overhead Direct materials Ending merchandise inventory Fixed expense Indirect labor Required 2 > Indirect materials Variable expenses Harris Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 30,000 to 50,000 units is given below: Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company produces and sells 45,000 units during the year at a selling price of $16 per unit. Prepare a contribution format income statement for the year. Harris Company Contribution Format Income Statement Net operating income Net operating loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts