Question: same question with independent inputs Consider the following information which relates to a given company: 2019 Value $6.46 $44.85 Item Earnings Per Share Price Per

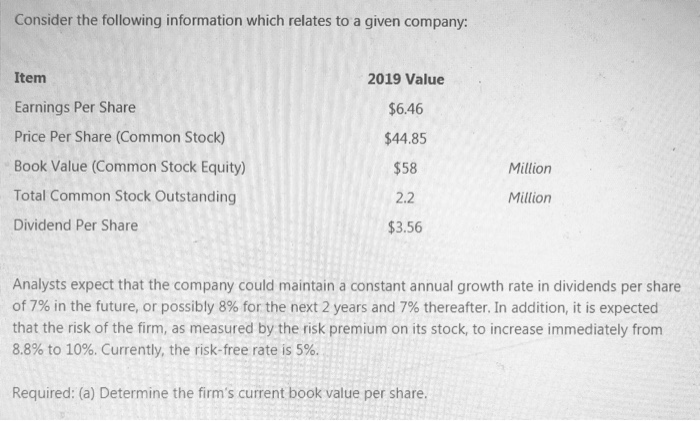

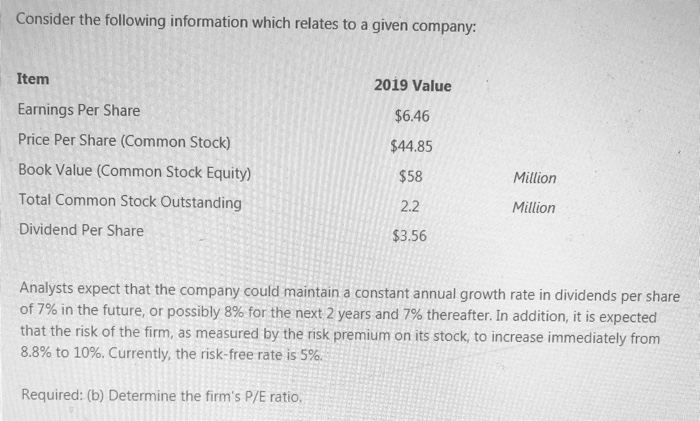

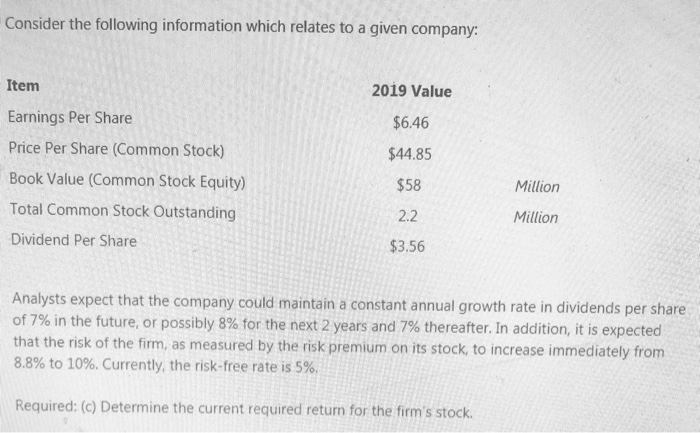

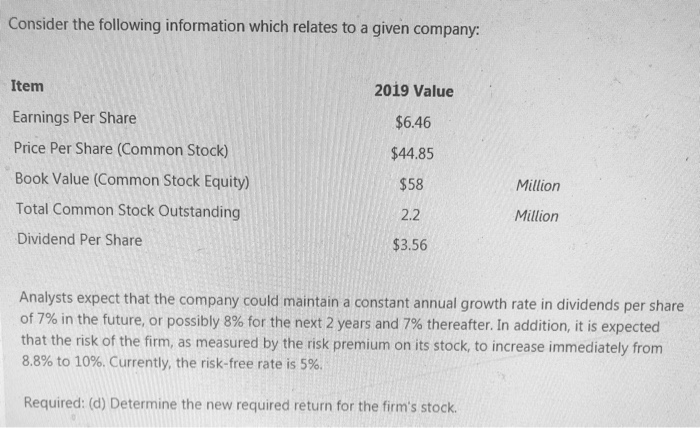

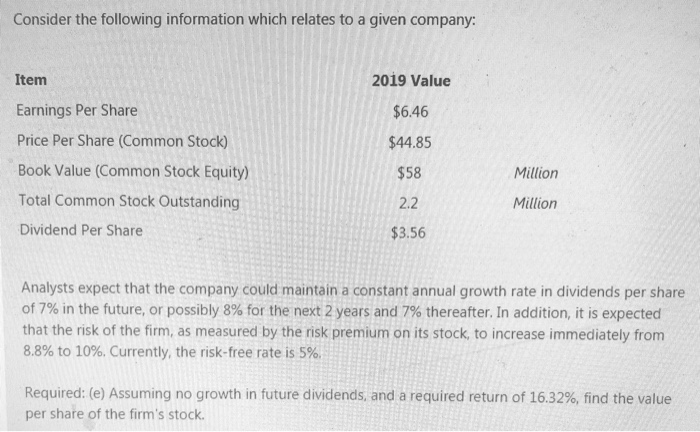

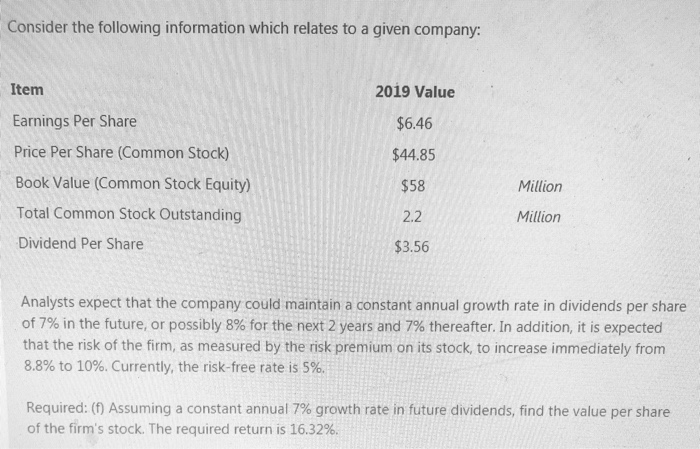

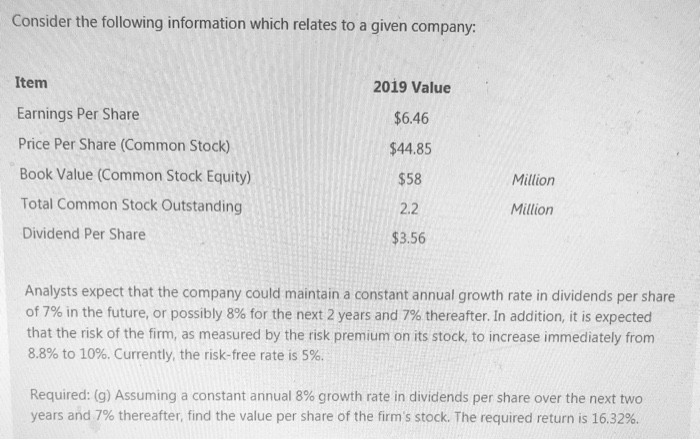

Consider the following information which relates to a given company: 2019 Value $6.46 $44.85 Item Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $58 Million 2.2 Million $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%. Required: (a) Determine the firm's current book value per share. Consider the following information which relates to a given company: Item 2019 Value $6.46 $44.85 Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $58 Million 2.2 Million $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%. Required: (b) Determine the firm's P/E ratio. Consider the following information which relates to a given company: Item 2019 Value Earnings Per Share $6.46 $44.85 $58 Million Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share 2.2 Million $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%, Required: (c) Determine the current required return for the firm's stock. Consider the following information which relates to a given company: Item 2019 Value $6.46 $44.85 Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $58 Million 2.2 Million $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5% Required: (d) Determine the new required return for the firm's stock. Consider the following information which relates to a given company: 2019 Value $6.46 Item Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $44.85 $58 Million 2.2 Million $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%. Required: (e) Assuming no growth in future dividends, and a required return of 16.32%, find the value per share of the firm's stock. Consider the following information which relates to a given company: Item 2019 Value Earnings Per Share $6.46 $44.85 $58 Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share Million Million 2.2 $3.56 Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%. Required: (f) Assuming a constant annual 7% growth rate in future dividends, find the value per share of the firm's stock. The required return is 16.32%. Consider the following information which relates to a given company: 2019 Value Item Earnings Per Share Price Per Share (Common Stock) Book Value (Common Stock Equity) Total Common Stock Outstanding Dividend Per Share $6.46 $44.85 $58 2.2 $3.56 Million Million Analysts expect that the company could maintain a constant annual growth rate in dividends per share of 7% in the future, or possibly 8% for the next 2 years and 7% thereafter. In addition, it is expected that the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 5%. Required: (g) Assuming a constant annual 8% growth rate in dividends per share over the next two years and 7% thereafter, find the value per share of the firm's stock. The required return is 16.32%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts