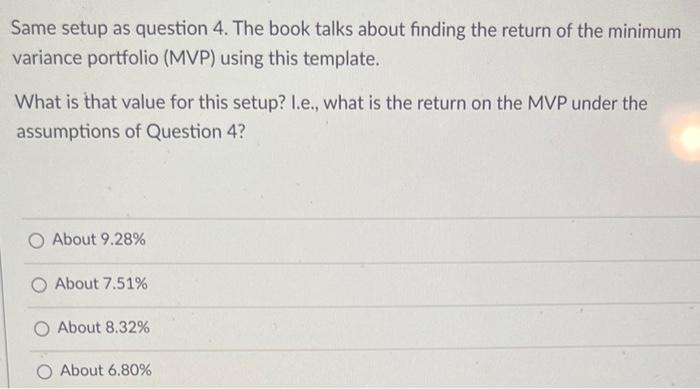

Question: Same setup as question 4 . The book talks about finding the return of the minimum variance portfolio (MVP) using this template. What is that

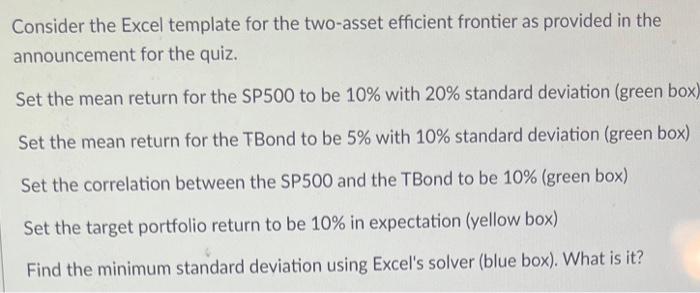

Same setup as question 4 . The book talks about finding the return of the minimum variance portfolio (MVP) using this template. What is that value for this setup? I.e., what is the return on the MVP under the assumptions of Question 4? About 9.28\% About 7.51% About 8.32\% About 6.80% Consider the Excel template for the two-asset efficient frontier as provided in the announcement for the quiz. Set the mean return for the SP500 to be 10% with 20% standard deviation (green bo. Set the mean return for the TBond to be 5% with 10% standard deviation (green box) Set the correlation between the SP500 and the TBond to be 10% (green box) Set the target portfolio return to be 10% in expectation (yellow box) Find the minimum standard deviation using Excel's solver (blue box). What is it? Same setup as question 4 . The book talks about finding the return of the minimum variance portfolio (MVP) using this template. What is that value for this setup? I.e., what is the return on the MVP under the assumptions of Question 4? About 9.28\% About 7.51% About 8.32\% About 6.80% Consider the Excel template for the two-asset efficient frontier as provided in the announcement for the quiz. Set the mean return for the SP500 to be 10% with 20% standard deviation (green bo. Set the mean return for the TBond to be 5% with 10% standard deviation (green box) Set the correlation between the SP500 and the TBond to be 10% (green box) Set the target portfolio return to be 10% in expectation (yellow box) Find the minimum standard deviation using Excel's solver (blue box). What is it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts