Question: sample exams on investment analysis Question Three (a) Brielly explain the international Fisher effect as it applies in the determination of exchange rate (8 marks)

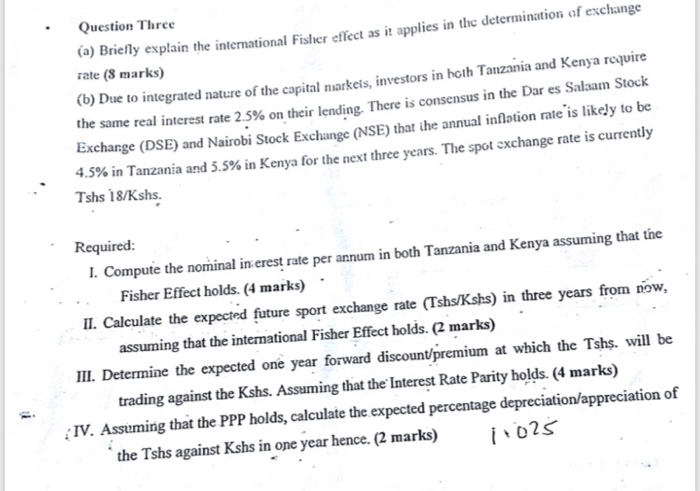

Question Three (a) Brielly explain the international Fisher effect as it applies in the determination of exchange rate (8 marks) (b) Due to integrated nature of the capital markets, investors in hoth Tanzania and Kenya require the same real interest rate 2.5% on their lending. There is consensus in the Dar es Salaam Stock Exchange (DSE) and Nairobi Stock Exchange (NSE) that ihe annual inflation rate is likely to be 4.5% in Tanzania and 5.5% in Kenya for the next three years. The spot exchange rate is currently Tshs 18/Kshs. Required: 1. Compute the nominal in erest rate per annum in both Tanzania and Kenya assuming that the ... Fisher Effect holds. (4 marks) II. Calculate the expected future sport exchange rate (Tshs/Kshs) in three years from now, assuming that the international Fisher Effect holds. (2 marks) III. Determine the expected one year forward discount/premium at which the Tshs. will be trading against the Kshs. Assuming that the Interest Rate Parity holds. (4 marks) IV. Assuming that the PPP holds, calculate the expected percentage depreciation/appreciation of the Tshs against Kshs in one year hence. (2 marks) 11025

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts