Question: Sample Question and Solution Your firm is considering an investment that will cost $1.5 million today today. The project will produce cash flows of $350,000

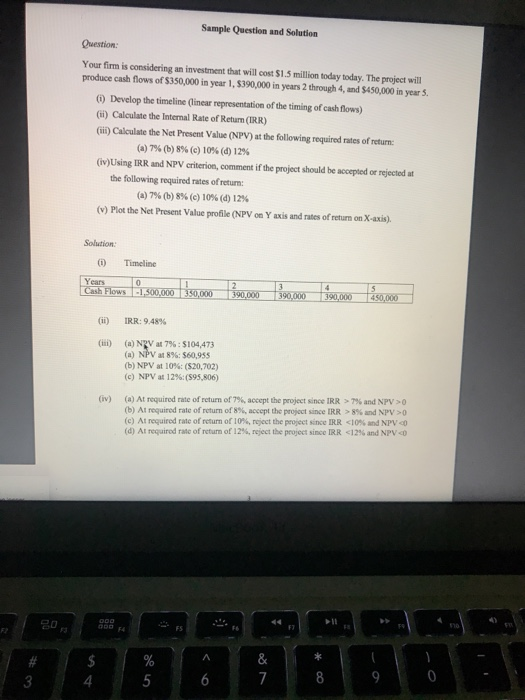

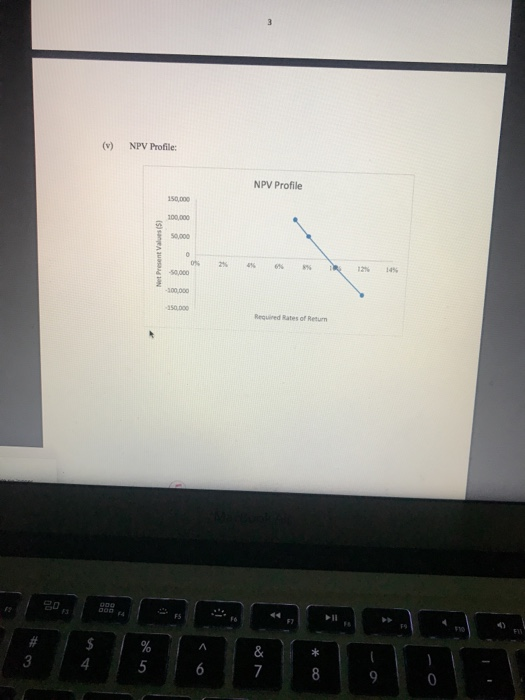

Sample Question and Solution Your firm is considering an investment that will cost $1.5 million today today. The project will produce cash flows of $350,000 in year 1, $390,000 in years 2 through 4, and $450,000 in year S (1) Develop the timeline (linear representation of the timing of cash flows) (ii) Calculate the Internal Rate of Return (IRR) (ii) Calculate the Net Present Value (NPV) at the following required rates of return: (a) 7% (b) 8% (c) 10% (d) 12% (iv)Using IRR and NPV criterion, comment if the project should be accepted or rejected at the following required rates of return (a) 7% (b) 8% (c) 10% (d) 12% (v) Plot the Net Present Value profile (NPV on Y axis and rates of return on X-axis). Timeline Years 390 000 T9010 o s000390 000 IRR: 9.48% (ii) (a) Ngva17% : S104.473 (iii) (a) NPV at 8%: $60,955 (b) NPV at 10%: (S20,702) (c) NPV at 12%:(S95,806) (a) At required rate of return of 79, accept the project since IRR > 7% and NPV > 0 (b) At required rate of return of 8%, accept the project since IRR > 8% and NPV >0 (c) At required rate of return of 10%,reject the project since IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts