Question: Sample Test Problem 9.03 x Your answer is incorrect. Try again. Sheridan, Inc., is a mature firm that is growing at a constant rate of

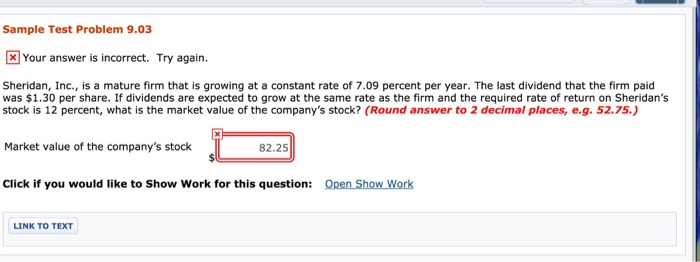

Sample Test Problem 9.03 x Your answer is incorrect. Try again. Sheridan, Inc., is a mature firm that is growing at a constant rate of 7.09 percent per year. The last dividend that the firm paid was $1.30 per share. If dividends are expected to grow at the same rate as the firm and the required rate of return on Sheridan's stock is 12 percent, what is the market value of the company's stock? (Round answer to 2 decimal places, e.g. 52.75.) Market value of the company's stock 82.25 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts