Question: Sample Test Questions for Topic 2 1. Assume that you buy a 7 percent coupon, 20 year bond today when it is first issued. If

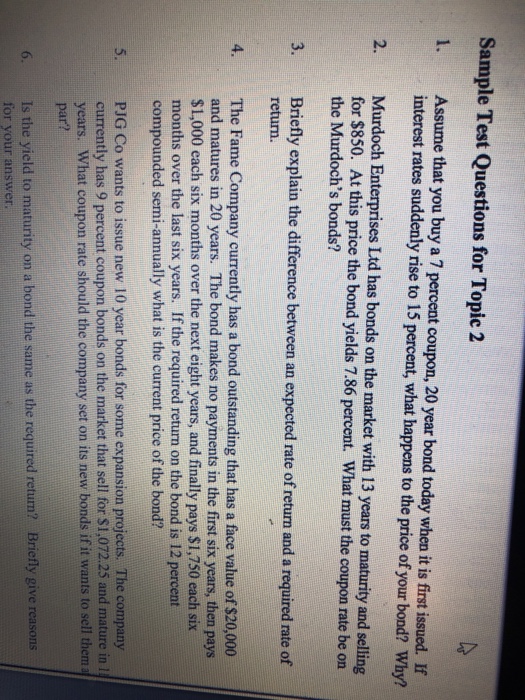

Sample Test Questions for Topic 2 1. Assume that you buy a 7 percent coupon, 20 year bond today when it is first issued. If interest rates suddenly rise to 15 percent, what happens to the price of your bond? Why? 2. Murdoch Enterprises Ltd has bonds on the market with 13 years to maturity and selling for $850. At this price the bond yields 7.86 percent. What must the coupon rate be on the Murdoch's bonds'? Briefly explain the difference between an expected rate of return and a required rate of return. The Fame Company currently has a bond outstanding that has a face value of $20,000 and matures in 20 years. The bond makes no payments in the first six years, then pays $1,000 each six months over the next eight years, and finally pays $1,750 each six months over the last six years. If the required return on the bond is 12 percent compounded semi-annually what is the current price of the bond? 4. PJG Co wants to issue new 10 year bonds for some expansion projects. The company currently has 9 percent coupon bonds on the market that sell for $1,072.25 and mature in years. What coupon rate should the company set on its new bonds if it wants to sell therm par? 5. 6. Is the yield to maturity on a bond the same as the required return? Briefly give reasons for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts