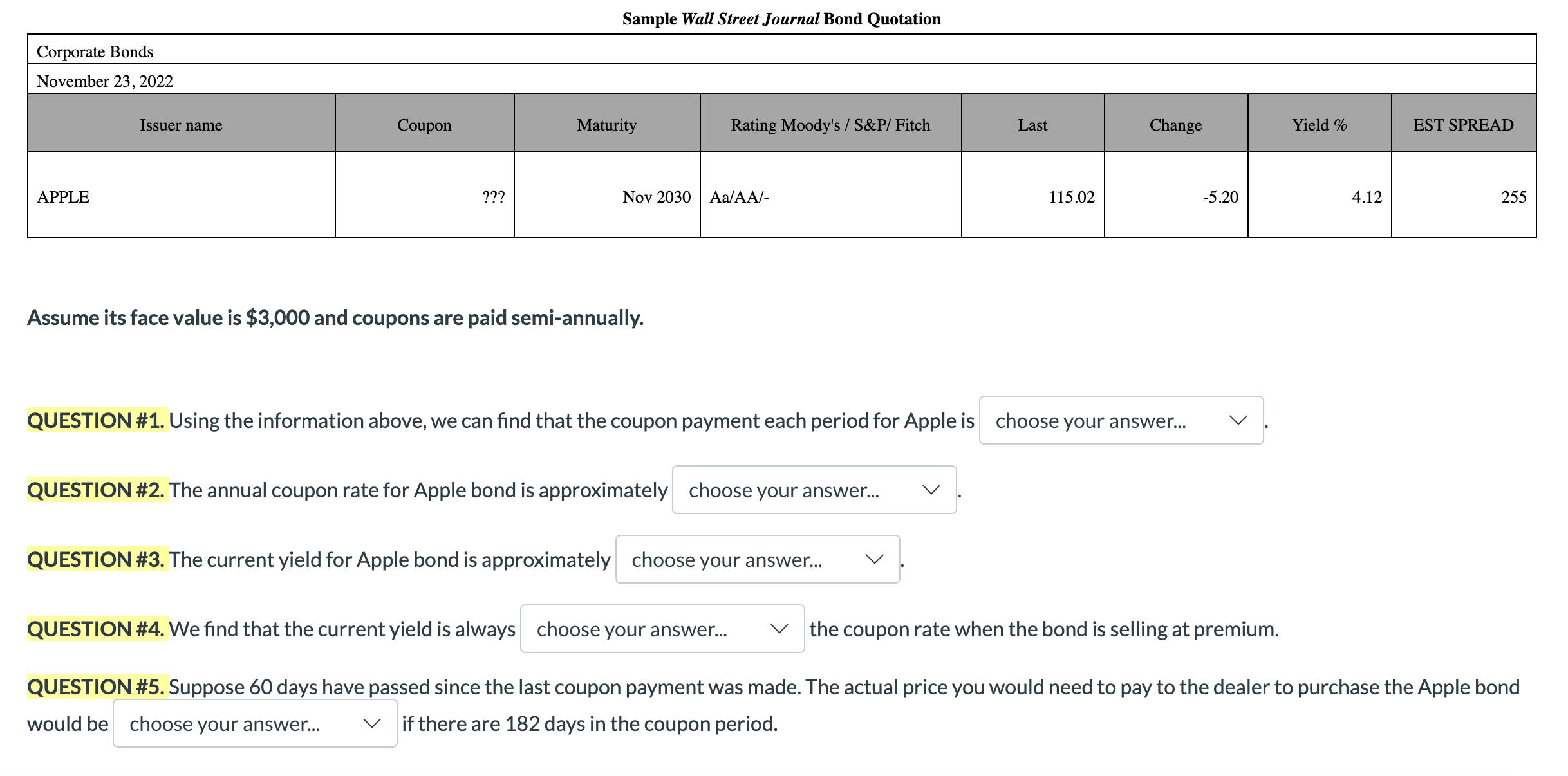

Question: Sample Wall Street Journal Bond Quotation Assume its face value is $ 3 , 0 0 0 and coupons are paid semi - annually. QUESTION

Sample Wall Street Journal Bond Quotation Assume its face value is $ and coupons are paid semiannually. QUESTION # Using the information above, we can find that the coupon payment each period for Apple is choose your answer... options: $ $ $ $ QUESTION # The annual coupon rate for Apple bond is approximatel options: QUESTION # The current yield for Apple bond is approximatel options: QUESTION # We find that the current yield is always choose your answer... options: greater than, equal to smaller than the coupon rate when the bond is selling at premium. QUESTION # Suppose days have passed since the last coupon payment was made. The actual price you would need to pay to the dealer to purchase the Apple bond would be choose your answer... options: $ $ $ $ if there are days in the coupon period.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock