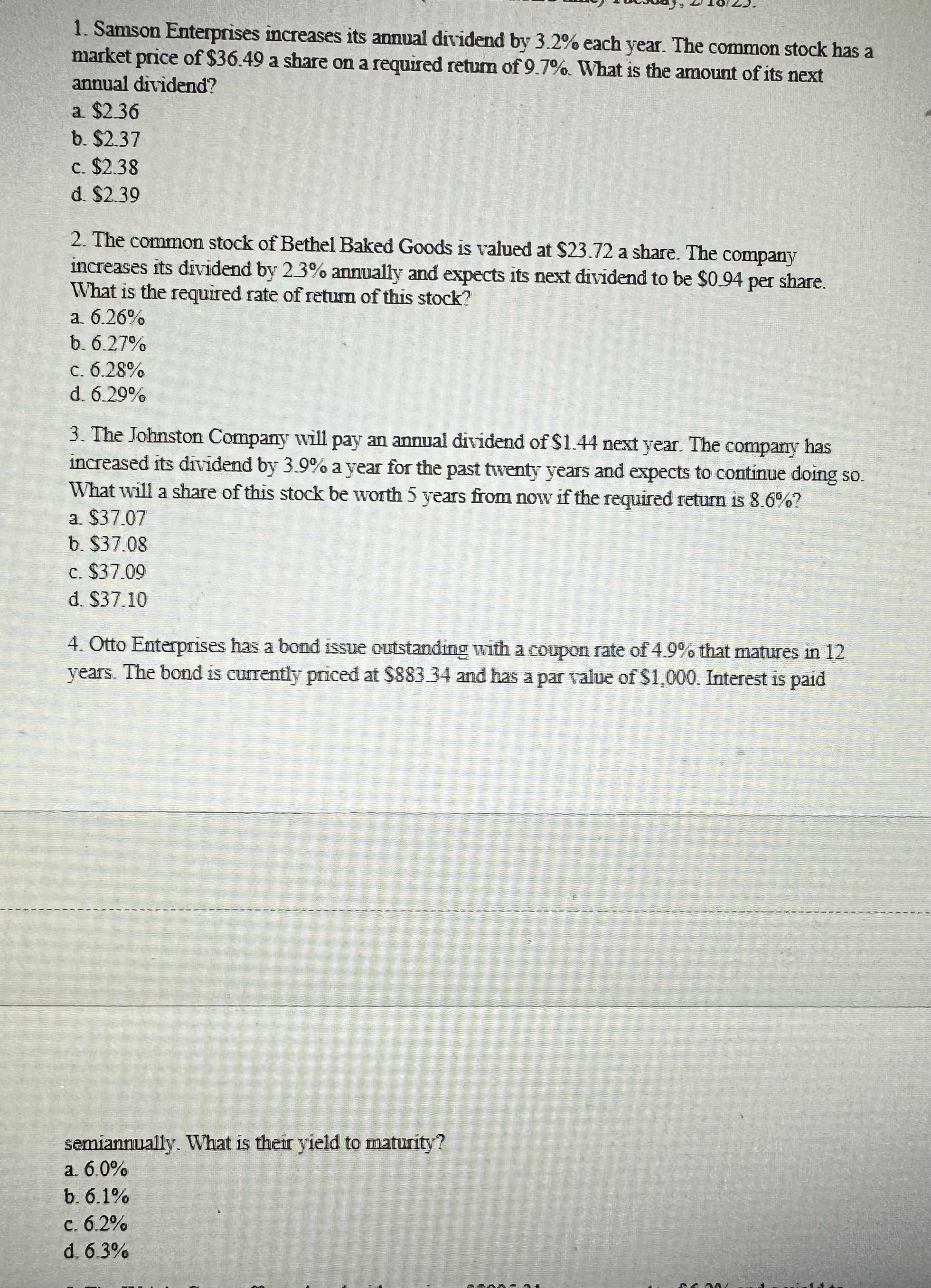

Question: Samson Enterprises increases its annual dividend by 3 . 2 % each year. The common stock has a market price of $ 3 6 .

Samson Enterprises increases its annual dividend by each year. The common stock has a market price of $ a share on a required retum of What is the amount of its next annual dividend?

a $

b $

c $

d $

The common stock of Bethel Baked Goods is valued at $ a share. The company increases its dividend by annually and expects its next dividend to be $ per share. What is the required rate of return of this stock?

a

b

c

d

The Johnston Company will pay an annual dividend of $ next year. The compary has increased its dividend by a year for the past twenty years and expects to continue doing so What will a share of this stock be worth years from now if the required return is

a $

b $

c $

d $

Otto Enterprises has a bond issue outstanding with a coupon rate of that matures in years. The bond is currently priced at $ and has a par value of $ Interest is paid

semiannually. What is their yield to maturity?

a

b

c

d

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock