Question: Samuelson and Messenger (S&M) began 2013 with 360 units of its one product. These units were purchased near the end of 2012 for $25 each.

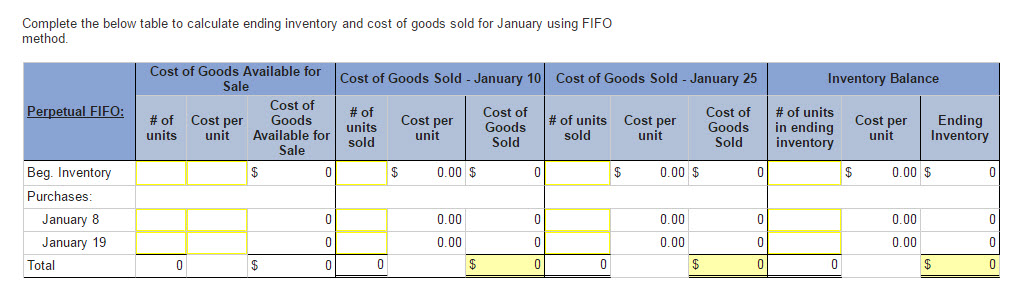

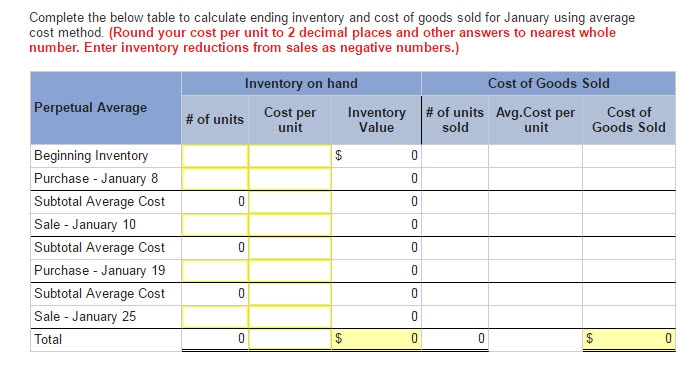

Samuelson and Messenger (S&M) began 2013 with 360 units of its one product. These units were purchased near the end of 2012 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. S&M uses a perpetual inventory system. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO method. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost method. (Round your cost per unit to 2 decimal places and other answers to nearest whole number. Enter inventory reductions from sales as negative numbers.)

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO method ost o Cost of Goods Sold - January 10 Cost of Goods Sold - January 25 Inventory Balance Sale Cost of Cost of Goods | # of units | in ending Perpetual FIF #of Cost per! Goods Cost of #of Cost per Goods units unit Available for | # of units sold Cost per unit Cost per | Ending Inventory units unit unit sold Sold Sold inventory Sale Beg. Inventory 0.00 $ 0.00 $ 0.00 $ Purchases January 8 January 19 0.00 0.00 0.00 0.00 0.00 0.00 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts