Question: Samuelson, Inc., has just purchased a $705,000 machine to produce calculators. The machine will be fully depreciated by the straight-line method over its economic life

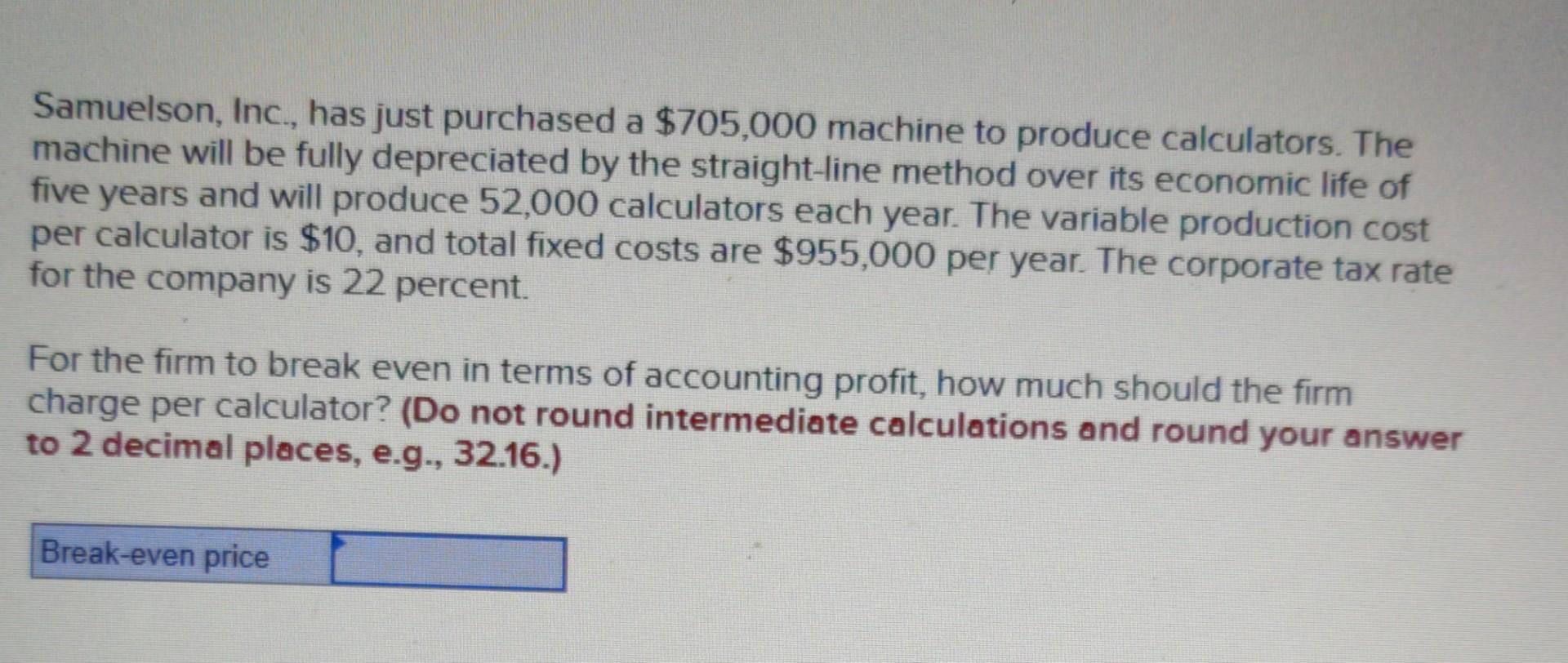

Samuelson, Inc., has just purchased a $705,000 machine to produce calculators. The machine will be fully depreciated by the straight-line method over its economic life of five years and will produce 52,000 calculators each year. The variable production cost per calculator is $10, and total fixed costs are $955,000 per year. The corporate tax rate for the company is 22 percent. For the firm to break even in terms of accounting profit, how much should the firm charge per calculator? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Break-even price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts