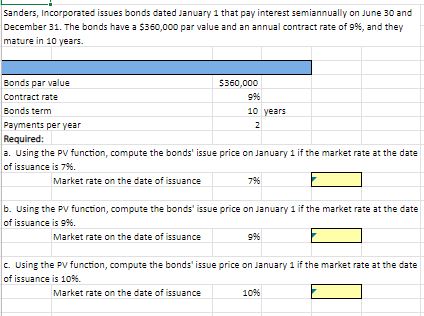

Question: Sanders, Incorporated issues bonds dated January 1 that pay interest semiannually on June 3 0 and December 3 1 . The bonds have a $

Sanders, Incorporated issues bonds dated January that pay interest semiannually on June and December The bonds have a $ par value and an annual contract rate of and they mature in years.

Required:

Using the PV function, compute the bonds' issue price on January assuming:

The market rate at the date of issuance is

The market rate at the date of issuance is

The market rate at the date of issuance is Sanders, Incorporated issues bonds dated January that pay interest semiannually on June and December The bonds have a $ par value and an annual contract rate of and they mature in years.

a Using the PV function, compute the bonds' issue price on January if the market rate at the date of issuance is

b Using the PV function, compute the bonds' issue price on January if the market rate at the date of issuance is

C Using the PV function, compute the bonds' issue price on January if the market rate at the date of issuance is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock