Question: Sandhill Construction is constructing an office building under contract for Cannon Company and uses the percentage of completion method. The contract calls for progress billines

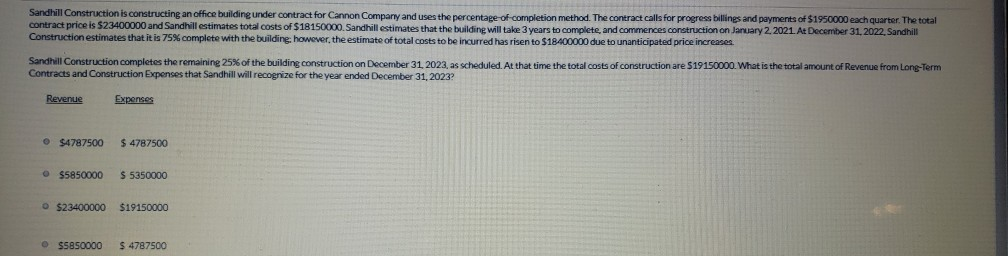

Sandhill Construction is constructing an office building under contract for Cannon Company and uses the percentage of completion method. The contract calls for progress billines and payments of $1950000 each quarter. The total contract price is 523400000 and Sandhill estimates total costs of $18150000. Sandhill estimates that the building will take 3 years to complete and commences construction on January 2 2021. At December 31, 2022. Sandhill Construction estimates that it is 75% complete with the building, however, the estimate of total costs to be incurred has risen to $18400000 due to unanticipated price increases Sandhill Construction completes the remaining 25% of the building construction on December 31, 2023, as scheduled. At that time the total costs of construction are 519150000. What is the total amount of Revenue from Lone Term Contracts and Construction Expenses that Sandhill will recognize for the year ended December 31, 2023 Revenue Expenses $4787500 $ 4787500 $5850000 5350000 $23400000 519150000 SS850000 $ 4787500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts