Question: Sandhill Corp. ' s operations in 2 0 2 3 had mixed results. One division, Vincenti Group, again failed to earn income at a rate

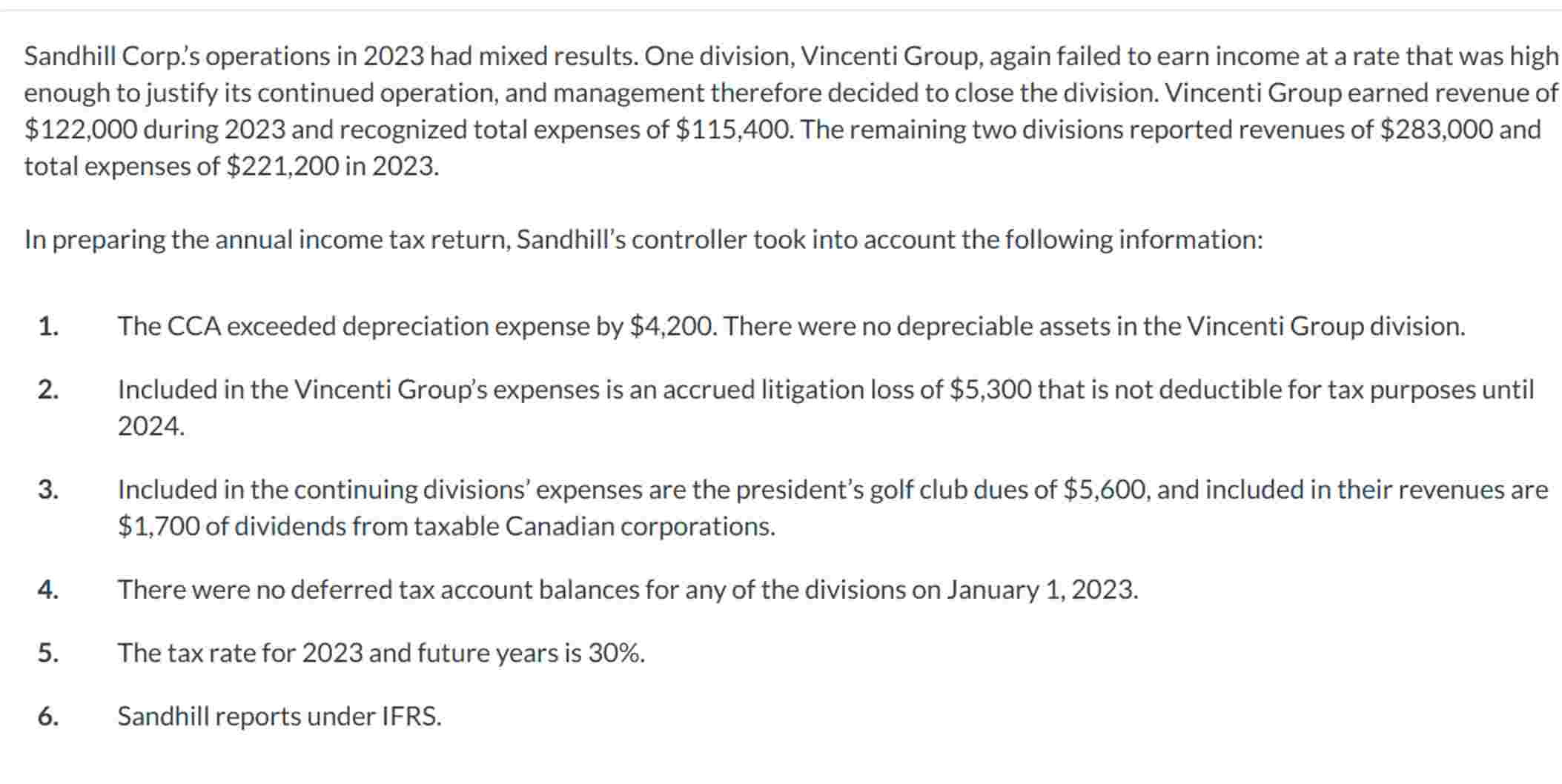

Sandhill Corp.s operations in had mixed results. One division, Vincenti Group, again failed to earn income at a rate that was high enough to justify its continued operation, and management therefore decided to close the division. Vincenti Group earned revenue of $ during and recognized total expenses of $ The remaining two divisions reported revenues of $ and total expenses of $ in In preparing the annual income tax return, Sandhill's controller took into account the following information: The CCA exceeded depreciation expense by $ There were no depreciable assets in the Vincenti Group division. Included in the Vincenti Group's expenses is an accrued litigation loss of $ that is not deductible for tax purposes until Included in the continuing divisions' expenses are the president's golf club dues of $ and included in their revenues are $ of dividends from taxable Canadian corporations. There were no deferred tax account balances for any of the divisions on January The tax rate for and future years is Sandhill reports under IFRS. Calculate the taxable income and income tax payable by Sandhill in and the Deferred Tax Asset or Deferred Tax Liability balances at December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock