Question: Sandhill Electronics Issues a $580,000, 10-year, 8% mortgage note payable on December 31, 2021, to help finance a plant expansion. The terms of the note

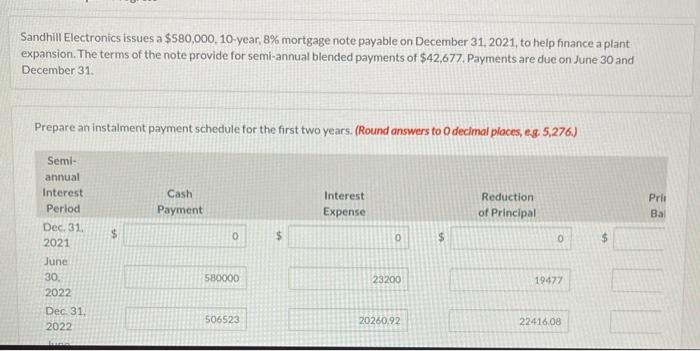

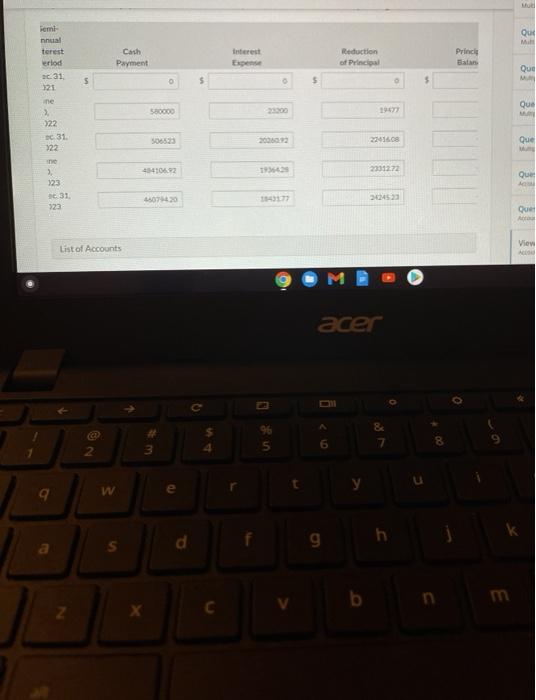

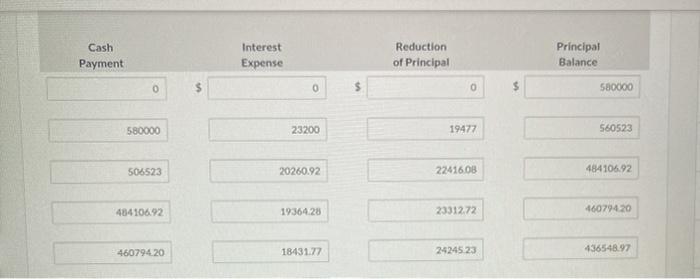

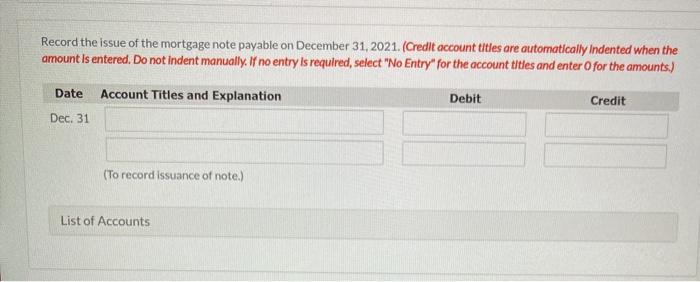

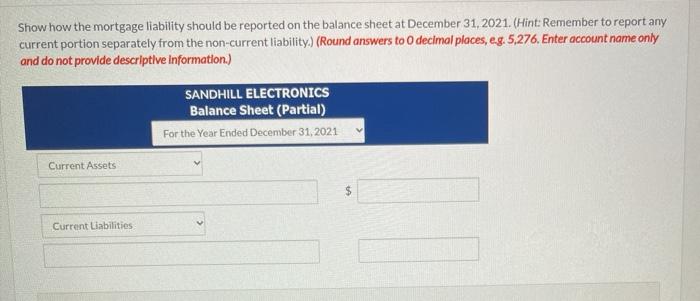

Sandhill Electronics Issues a $580,000, 10-year, 8% mortgage note payable on December 31, 2021, to help finance a plant expansion. The terms of the note provide for semi-annual blended payments of $42,677. Payments are due on June 30 and December 31. Prepare an instalment payment schedule for the first two years. (Round answers to decimal places, eg 5,276) Semi- annual Interest Period Cash Payment Interest Expense Reduction of Principal Prii Ba $ 0 0 S 0 $ Dec. 31. 2021 June 30 2022 Dec. 31. 2022 580000 23200 1947% 506523 20260.92 22416 08 Que ME Romi nnual terest terlod ac 31 125 Cash Payment Interest Expense eduction of Principal Prince Batan Que S $ Que 580000 ine > -322 --031 122 201608 Que 4541042 Que A 123 30 31 ya 0740 30453 Que A View List of Accounts acer 7 3 9 w e d g h b. n. Cash Payment Interest Expense Reduction of Principal Principal Balance 0 0 0 580000 580000 23200 19477 560523 506523 20260.92 224160B 484106.92 484106.92 1936428 2331272 46079420 460794 20 18431.77 2424523 436548.97 Record the issue of the mortgage note payable on December 31, 2021. (Credit account titles are automatically Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 (To record issuance of note.) List of Accounts Show how the mortgage liability should be reported on the balance sheet at December 31, 2021. (Hint: Remember to report any current portion separately from the non-current liability.) (Round answers to decimal places, eg. 5,276. Enter account name only and do not provide descriptive Information.) SANDHILL ELECTRONICS Balance Sheet (Partial) For the Year Ended December 31, 2021 Current Assets $ Current Liabilities 5.276. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. I no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit June 30 (To record payment on note) Dec. 31 9 (To record payment on note) List of Accounts S2 acer . % 5 7 9 1 3 8 2 4 W 9 a S d h 9 n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts