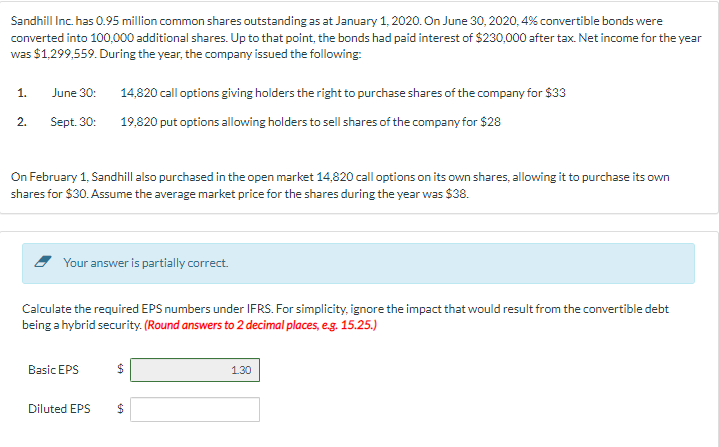

Question: Sandhill Inc. has 0.95 million common shares outstanding as at January 1, 2020. On June 30, 2020,4% convertible bonds were converted into 100.000 additional shares.

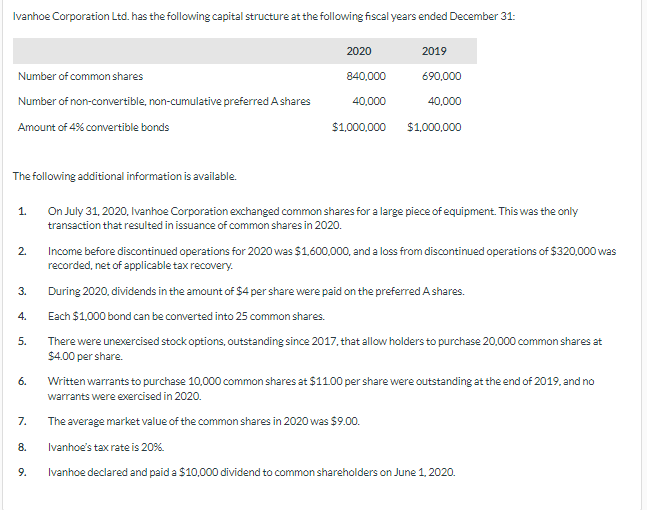

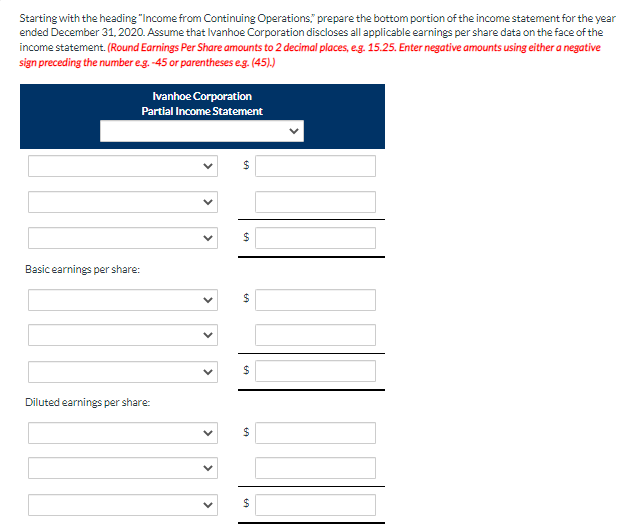

Sandhill Inc. has 0.95 million common shares outstanding as at January 1, 2020. On June 30, 2020,4% convertible bonds were converted into 100.000 additional shares. Up to that point, the bonds had paid interest of $230,000 after tax. Net income for the year was $1,299,559. During the year, the company issued the following: 1. June 30: 14,820 call options giving holders the right to purchase shares of the company for $33 19,820 put options allowing holders to sell shares of the company for $28 2. Sept. 30: On February 1, Sandhill also purchased in the open market 14,820 call options on its own shares, allowing it to purchase its own shares for $30. Assume the average market price for the shares during the year was $38. Your answer is partially correct. Calculate the required EPS numbers under IFRS. For simplicity, ignore the impact that would result from the convertible debt being a hybrid security. (Round answers to 2 decimal places, e.g. 15.25.) Basic EPS $ $ 1.30 Diluted EPS $ $ Ivanhoe Corporation Ltd. has the following capital structure at the following fiscal years ended December 31: Number of common shares Number of non-convertible, non-cumulative preferred Ashares Amount of 4% convertible bonds 2020 840,000 40.000 $1.000.000 2019 690.000 40,000 $1,000,000 The following additional information is available. 1. 2. 3. 4. 5. On July 31, 2020, Ivanhoe Corporation exchanged common shares for a large piece of equipment. This was the only transaction that resulted in issuance of common shares in 2020. Income before discontinued operations for 2020 was $1.600.000, and a loss from discontinued operations of $320,000 was recorded, net of applicable tax recovery. During 2020. dividends in the amount of $4 per share were paid on the preferred Ashares. Each $1,000 bond can be converted into 25 common shares. There were unexercised stock options, outstanding since 2017, that allow holders to purchase 20.000 common shares at $4.00 per share. Written warrants to purchase 10,000 common shares at $11.00 per share were outstanding at the end of 2019, and no warrants were exercised in 2020. The average market value of the common shares in 2020 was $9.00 Ivanhoe's tax rate is 20% Ivanhoe declared and paid a $10,000 dividend to common shareholders on June 1, 2020. 6. 7. 7 . 8. 9. Starting with the heading "Income from Continuing Operations." prepare the bottom portion of the income statement for the year ended December 31, 2020. Assume that Ivanhoe Corporation discloses all applicable earnings per share data on the face of the income statement. (Round Earnings Per Share amounts to 2 decimal places, eg. 15.25. Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45).) Ivanhoe Corporation Partial Income Statement GA GA Basic earnings per share: $ $ Diluted earnings per share: $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts