Question: Sandia corporation is considering two mutually exclusive projects. For our purposes, we will call them projects A and B. Project A is expected to

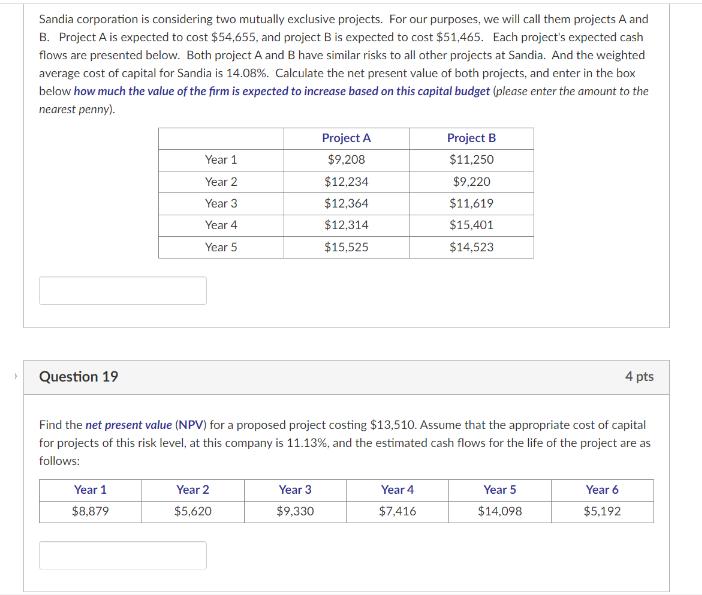

Sandia corporation is considering two mutually exclusive projects. For our purposes, we will call them projects A and B. Project A is expected to cost $54,655, and project B is expected to cost $51,465. Each project's expected cash flows are presented below. Both project A and B have similar risks to all other projects at Sandia. And the weighted average cost of capital for Sandia is 14.08%. Calculate the net present value of both projects, and enter in the box below how much the value of the firm is expected to increase based on this capital budget (please enter the amount to the nearest penny). Question 19 Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 $8,879 Year 2 $5,620 Project A $9,208 $12,234 $12,364 $12,314 $15,525 Find the net present value (NPV) for a proposed project costing $13,510. Assume that the appropriate cost of capital for projects of this risk level, at this company is 11.13%, and the estimated cash flows for the life of the project are as follows: Year 3 $9,330 Project B $11,250 $9,220 $11,619 $15,401 $14,523 Year 4 $7,416 Year 5 $14,098 4 pts Year 6 $5,192

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV of a proposed project we need to discount the expected cash f... View full answer

Get step-by-step solutions from verified subject matter experts