Question: Sandra Peters (65 years old) has been a long-time client of H&P. As it is tax season!, your boss has asked you to review Sandra

Sandra Peters (65 years old) has been a long-time client of H&P. As it is tax season!, your boss has asked you to review Sandra Peters file and begin work on her tax return.

You have been given the following information:

- Sandra Peters has net income of $132,400, all of which is employment income, with the exception of a deduction for CPP of $290.

- Sandra Peters employer has withheld the maximum EI and CPP contributions.

- Sandra Peters and her husband, Bob, have two children Maggie (aged 11) and Alyssa (13).

- Her husband and the children have no income of their own during the current year.

- Two years ago, the Alyssa was severely injured in a car accident and qualifies for the disability tax credit. No amount was paid for attendant care for this child during the current year.

- Sandra Peters spend $12,500 installing wheelchair ramps to improve access to various parts of the family residence. She also spent the following on dental fees and fees for various medical practitioners:

- Sandra $4,420

- Bob $2,620

- Maggie $1,875

- Alyssa $14,250

Total medical fees paid $23,165

Reimbursement (11,000) (from the companys medical plan)

Net medical fees paid $12,165

You may assume that the Sandra Peters net income is equal to her taxable income. Ignore the possibility of pension income splitting, if relevant.

Required: Determine the maximum amount of 2021 personal tax credits for Sandra Peters, including any transfers from a spouse or dependent, that can be applied against federal income tax payable by the individual.

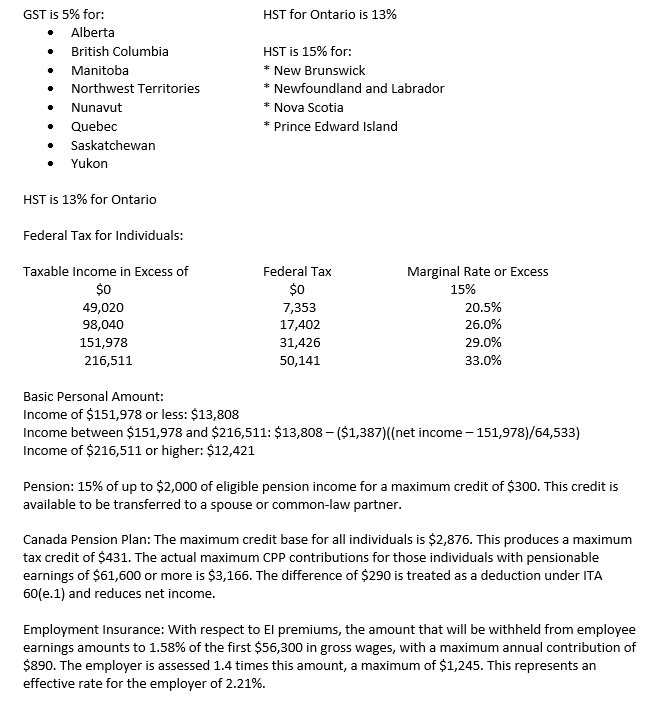

HST for Ontario is 13% GST is 5% for: Alberta British Columbia Manitoba Northwest Territories Nunavut Quebec Saskatchewan Yukon HST is 15% for: * New Brunswick * Newfoundland and Labrador * Nova Scotia * Prince Edward Island . HST is 13% for Ontario Federal Tax for Individuals: Taxable income in Excess of $0 49,020 98,040 151,978 216,511 Federal Tax $0 7,353 17,402 31,426 50,141 Marginal Rate or Excess 15% 20.5% 26.0% 29.0% 33.0% Basic Personal Amount: Income of $151,978 or less: $13,808 Income between $151,978 and $216,511: $13,808 - ($1,387)((net income 151,978)/64,533) Income of $216,511 or higher: $12,421 Pension: 15% of up to $2,000 of eligible pension income for a maximum credit of $300. This credit is available to be transferred to a spouse or common-law partner. Canada Pension Plan: The maximum credit base for all individuals is $2,876. This produces a maximum tax credit of $431. The actual maximum CPP contributions for those individuals with pensionable earnings of $61,600 or more is $3,166. The difference of $290 is treated as a deduction under ITA 60(e.1) and reduces net income. Employment Insurance: With respect to El premiums, the amount that will be withheld from employee earnings amounts to 1.58% of the first $56,300 in gross wages, with a maximum annual contribution of $890. The employer is assessed 1.4 times this amount, a maximum of $1,245. This represents an effective rate for the employer of 2.21%. HST for Ontario is 13% GST is 5% for: Alberta British Columbia Manitoba Northwest Territories Nunavut Quebec Saskatchewan Yukon HST is 15% for: * New Brunswick * Newfoundland and Labrador * Nova Scotia * Prince Edward Island . HST is 13% for Ontario Federal Tax for Individuals: Taxable income in Excess of $0 49,020 98,040 151,978 216,511 Federal Tax $0 7,353 17,402 31,426 50,141 Marginal Rate or Excess 15% 20.5% 26.0% 29.0% 33.0% Basic Personal Amount: Income of $151,978 or less: $13,808 Income between $151,978 and $216,511: $13,808 - ($1,387)((net income 151,978)/64,533) Income of $216,511 or higher: $12,421 Pension: 15% of up to $2,000 of eligible pension income for a maximum credit of $300. This credit is available to be transferred to a spouse or common-law partner. Canada Pension Plan: The maximum credit base for all individuals is $2,876. This produces a maximum tax credit of $431. The actual maximum CPP contributions for those individuals with pensionable earnings of $61,600 or more is $3,166. The difference of $290 is treated as a deduction under ITA 60(e.1) and reduces net income. Employment Insurance: With respect to El premiums, the amount that will be withheld from employee earnings amounts to 1.58% of the first $56,300 in gross wages, with a maximum annual contribution of $890. The employer is assessed 1.4 times this amount, a maximum of $1,245. This represents an effective rate for the employer of 2.21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts