Question: SandStone Enterprises Case Study Part 1 - Application / Communication SandStone Enterprises ( SSE ) was privately incorporated in 2 0 0 3 and services

SandStone Enterprises Case Study

Part ApplicationCommunication

SandStone Enterprises SSE was privately incorporated in and services the Greater Toronto Area in Ontario. SSE is in the "hardscaping" business, manufacturing and delivering various decorative stone products for residential walkways, patios, and retaining walls.

Recently, the financial controller for SSE retired, leaving the owner, Layla Solomon, looking for a new one. After several months of interviews, Layla made an offer to you for the position and with a hefty pay raise and substantial benefits, you accepted. This is your first week on the job, it is now August and you need to make all of the non current asset journal entries today that haven't been done as of yet. SSE's year end is August

The following events require your attention:

On April SSE purchased land, building, and equipment in Etobicoke for $ in total. The land was valued at $ the building at $ and the equipment at $ Additional amortization information is provided below:

Asset

Building

Residual Value

$

Equipment

Equipment

$

Useful Life Years

Method

Straightline

Doubledeclining

double the straightline rate

of the purchase price was paid in cash and the balance as a fiveyear loan. The loan carries a interest rate with equal annual principal payments every April Interest is also paid on April Although the transaction has taken place and possession has transferred, no entry has been made.

On July SSE sold one of its buildings in Muskoka for $ The building originally cost $ and had accumulated amortization of $ at the time of the sale. Amortization of $ that had accumulated up to July had not been recorded in the books. The proceeds were received in cash.

A patent from 'Imperial Stone & Design' was purchased by SSE in February for $ cash. It is expected that the patent, with a legal life of twenty years, will generate revenues for the next four years.

SSE has internally developed a strong customer list. The owner, Layla, has stated that this list is worth about $ if sold.

Some equipment was purchased on October of the previous calendar year at a cost of $ SSE estimated that the equipment will produce units over its fiveyear useful life, and have a residual value of $ During the current fiscal year, units were produced by this equipment. Assume the unitsofactivity method is used for amortization purposes.

On September of the previous calendar year the previous controller determined that trucks with a cost of $ and accumulated amortization of $ would actually have an estimated useful life of seven more years with no residual. The previous estimated useful life had been years, with four years having already passed so the useful life of seven years is from September and beyond

Additional information:

SSE records its amortization to the nearest month. In other words, an asset purchased August would have its amortization prorated ths

No entries have been made to reflect any of the transactions above.

Part Thinking

Layla received some great news on January ; her nearest competitor is going out of business! Thus, she expects a boost in her customer base. She's already started expanding her reputable management team in the expectation of business growth, and has plans to entice the most skilled hardscapers and designers from the competitor to come work for her.

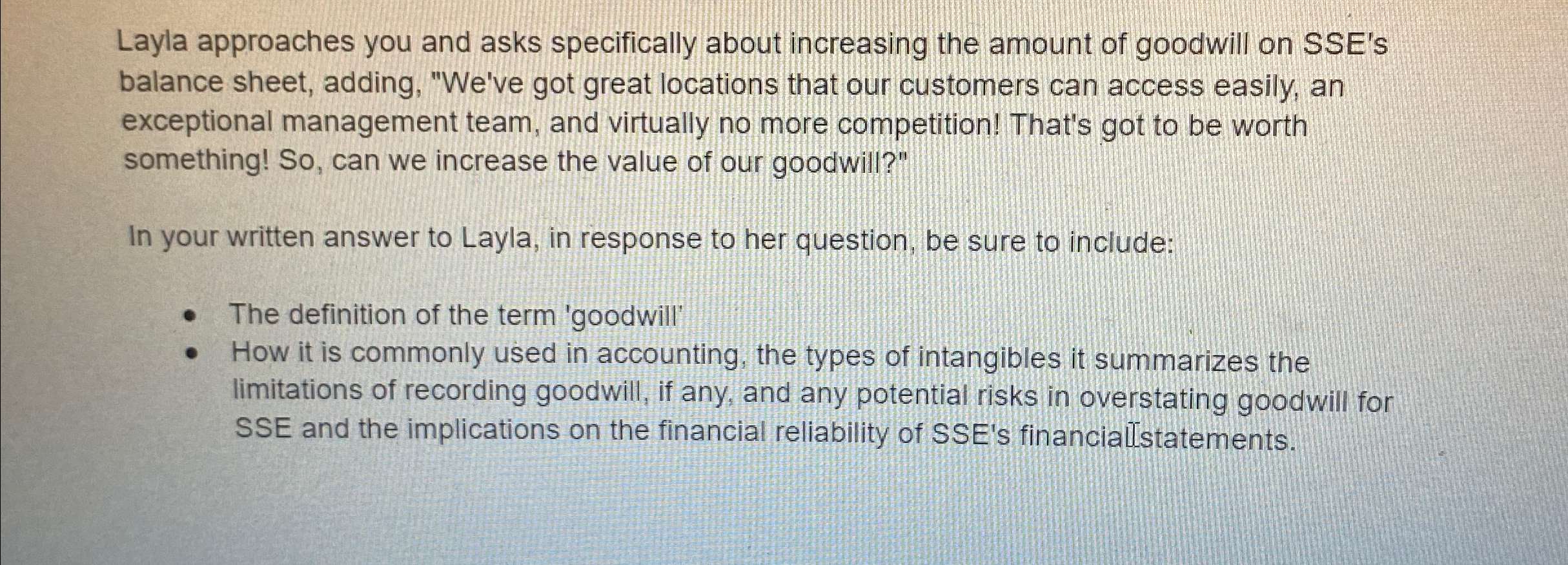

Layla approaches you and asks specifically about increasing the amount of goodwill on SSE's balance sheet, adding, "We've got great locations that our customers can access easily, an exceptional management team, and virtually no more competition! That's got to be worth something! So can we increase the value of our goodwill?"

In your written answer to Layla, in response to her question, be sure to include:

The definition of the term 'goodwill'

How it is commonly used in accounting, the types of intangibles it summarizes the limitations of recording goodwill, if any, and any potential risks in overstating goodwill for SSE and the implications on the financial reliability of SSE's financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock