Question: Sanicare Ltd. is considering acquiring a state-of-the-art sanitizing machine and is trying to decide whether to purchase the machine or lease it from the manufactu

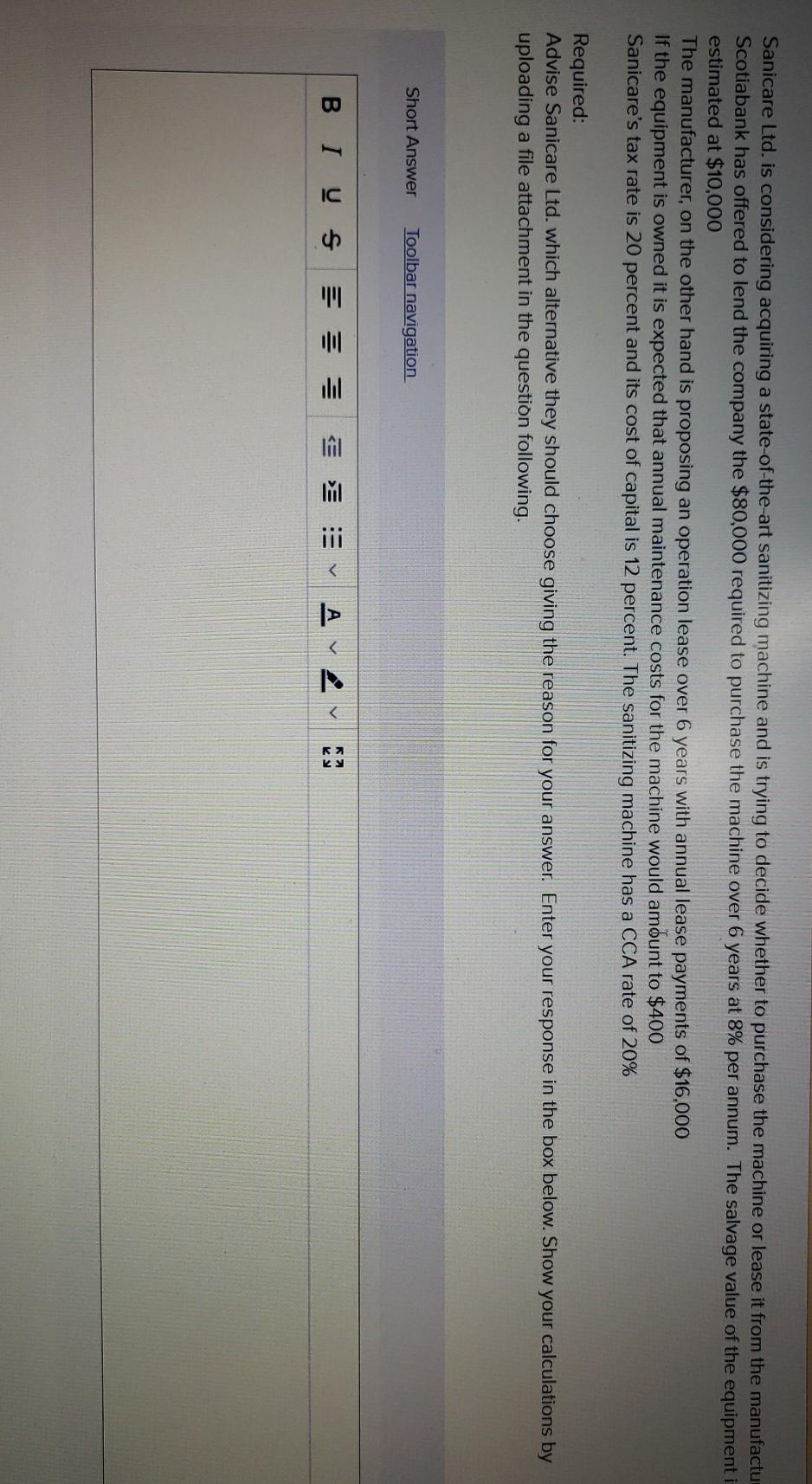

Sanicare Ltd. is considering acquiring a state-of-the-art sanitizing machine and is trying to decide whether to purchase the machine or lease it from the manufactu Scotiabank has offered to lend the company the $80,000 required to purchase the machine over 6 years at 8% per annum. The salvage value of the equipment i estimated at $10,000 The manufacturer, on the other hand is proposing an operation lease over 6 years with annual lease payments of $16,000 If the equipment is owned it is expected that annual maintenance costs for the machine would amount to $400 Sanicare's tax rate is 20 percent and its cost of capital is 12 percent. The sanitizing machine has a CCA rate of 20% Required: Advise Sanicare Ltd. which alternative they should choose giving the reason for your answer. Enter your response in the box below. Show your calculations by uploading a file attachment in the question following. Short Answer Toolbar navigation BI U s S > Ka

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts