Question: Santana Rey created Business Solutions on October 1 , 2 0 2 1 . Required: 1 . Prepare journal entries to record each of the

Santana Rey created Business Solutions on October Required:

Prepare journal entries to record each of the January through March transactions.

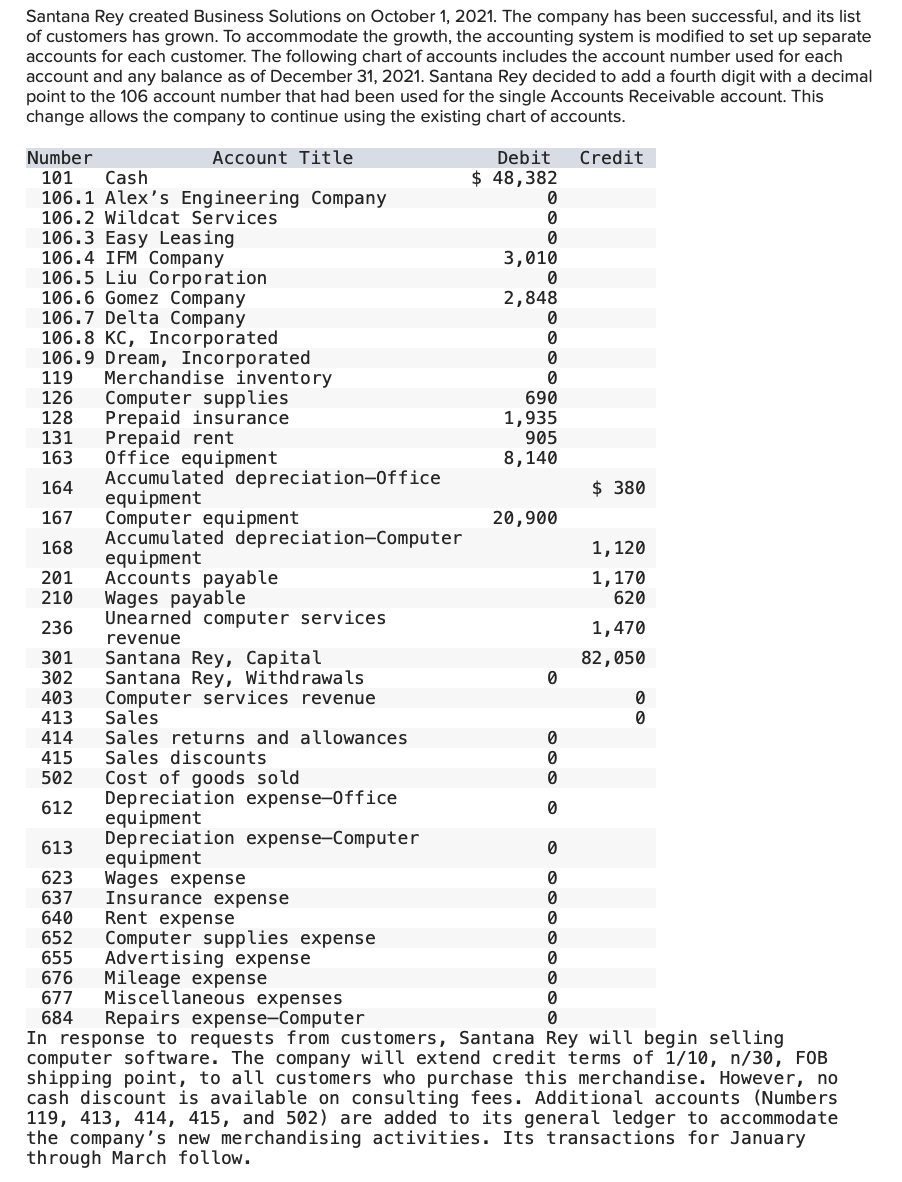

Post the journal entries in part to the accounts in the companys general ledger. Note: Begin with the ledgers postclosing adjusted balances as of December

Prepare a column work sheet that includes the unadjusted trial balance, the March adjustments a through g and the adjusted trial balance. Do not prepare closing entries and do not journalize the adjustments or post them to the ledger.

Prepare an income statement from the adjusted trial balance in part for the three months ended March

a Use a singlestep format. List all expenses without differentiating between selling expenses and general and administrative expenses.

b Use a multiplestep format that begins with gross sales service revenues plus gross product sales and includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. Categorize the following accounts as selling expenses: Wages Expense, Mileage Expense, and Advertising Expense. Categorize the remaining expenses as general and administrative.

Prepare a statement of owner's equity from the adjusted trial balance in part for the three months ended March

Prepare a classified balance sheet from the adjusted trial balance as of March Report Accounts receivable as a single amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock