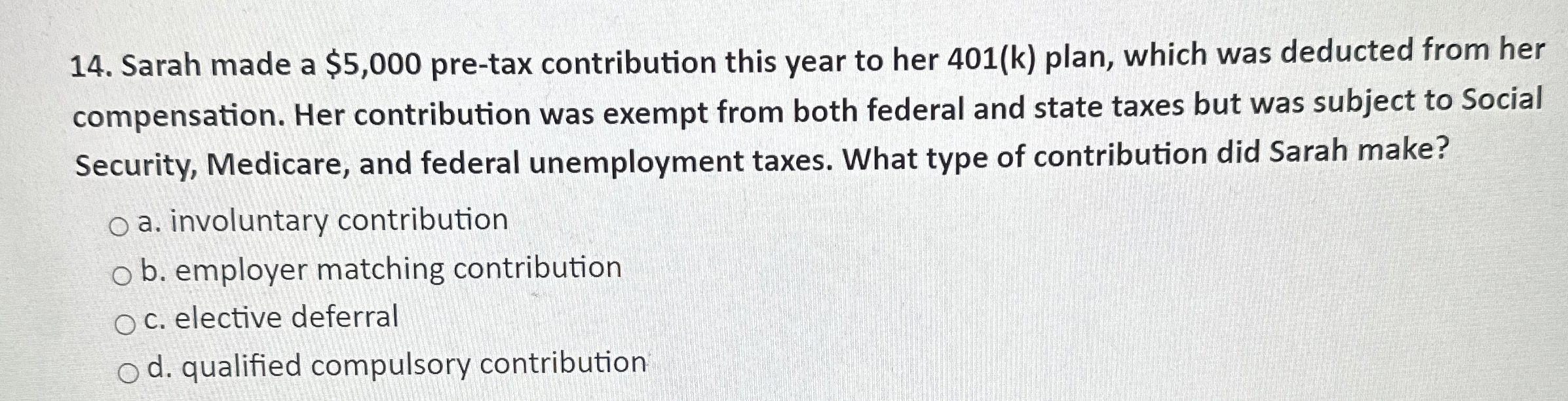

Question: Sarah made a $ 5 , 0 0 0 pre - tax contribution this year to her 4 0 1 ( k ) plan, which

Sarah made a $ pretax contribution this year to her plan, which was deducted from her compensation. Her contribution was exempt from both federal and state taxes but was subject to Social Security, Medicare, and federal unemployment taxes. What type of contribution did Sarah make?

a involuntary contribution

b employer matching contribution

c elective deferral

d qualified compulsory contribution

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock