Question: Sarved Help Save & EXIL Unit 7 - Chapter 10 Homework Assignment i Check my Lightning Electronics is a midsize manufacturer of lithium batteries. The

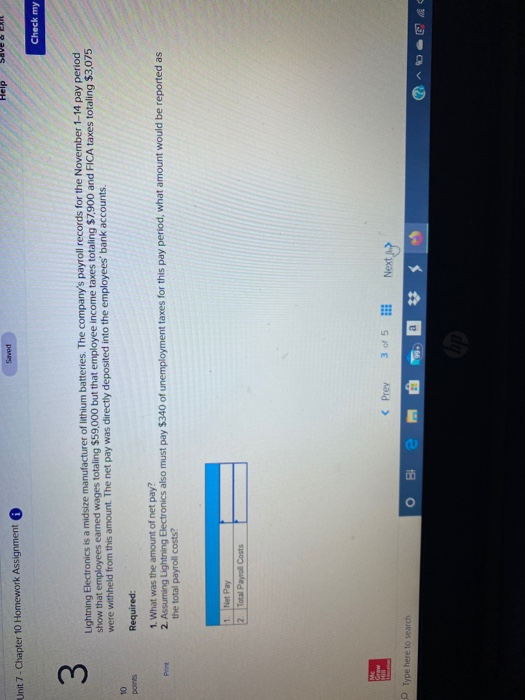

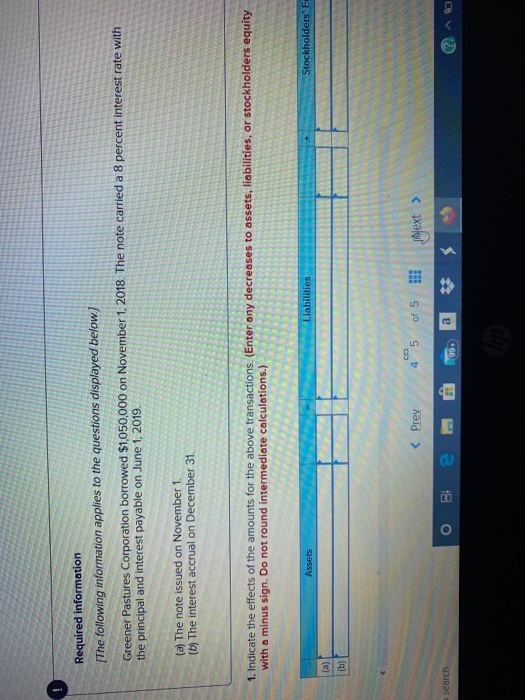

Sarved Help Save & EXIL Unit 7 - Chapter 10 Homework Assignment i Check my Lightning Electronics is a midsize manufacturer of lithium batteries. The company's payroll records for the November 1-14 pay period show that employees earned wages totaling $59,000 but that employee income taxes totaling $7,900 and FICA taxes totaling $3,075 were withheld from this amount. The net pay was directly deposited into the employees' bank accounts Required: 1. What was the amount of net pay? 2. Assuming Lightning Electronics also must pay $340 of unemployment taxes for this pay period, what amount would be reported as the total payroll costs? 1 Net Pay 2 Total Payroll Costs Type here to search Required information The following information applies to the questions displayed below) Greener Pastures Corporation borrowed $1,050,000 on November 1, 2018. The note carried a 8 percent interest rate with the principal and interest payable on June 1, 2019. (a) The note issued on November 1. (6) The interest accrual on December 31. 1. Indicate the effects of the amounts for the above transactions. (Enter any decreases to assets, liabilities, or stockholders equity with a minus sign. Do not round intermediate calculations.) Assets Liabilities Stockholders. E. search 'o Be . a *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts