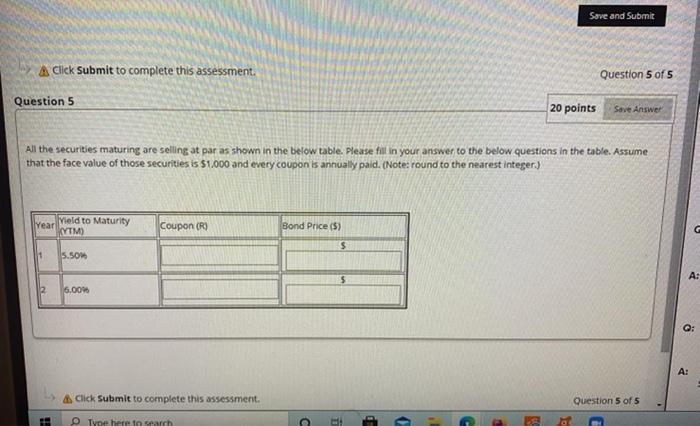

Question: Save and Submit A Click Submit to complete this assessment. Question 5 of 5 Question 5 20 points Save Answer An the securities maturing are

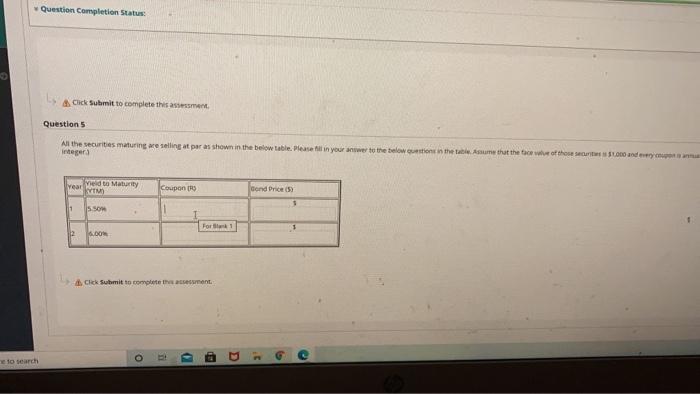

Save and Submit A Click Submit to complete this assessment. Question 5 of 5 Question 5 20 points Save Answer An the securities maturing are selling at par as shown in the below table. Please fill in your answer to the below questions in the table. Assume that the face value of those securities is $1.000 and every coupon is annually paid. (Note: round to the nearest integer.) Year Vield to Maturity T) Coupon (R) Bond Price (5) $ 1 5.50 $ 2 6.00% A: Click Submit to complete this assessment. Question 5 of 5 Type here to search 1 Question Completion Status Click Submit to complete this an Question 5 All the securities maturing we selling at paras shown in the below table. Please fill in your answer to the below in the table Assume that the tower of these and every Year vied to Maturity SVIM Coupon 17 Cand Price 1 Sow Foro 6.00 1. Click Submit to completenessement o . BD c to search Save and Submit A Click Submit to complete this assessment. Question 5 of 5 Question 5 20 points Save Answer An the securities maturing are selling at par as shown in the below table. Please fill in your answer to the below questions in the table. Assume that the face value of those securities is $1.000 and every coupon is annually paid. (Note: round to the nearest integer.) Year Vield to Maturity T) Coupon (R) Bond Price (5) $ 1 5.50 $ 2 6.00% A: Click Submit to complete this assessment. Question 5 of 5 Type here to search 1 Question Completion Status Click Submit to complete this an Question 5 All the securities maturing we selling at paras shown in the below table. Please fill in your answer to the below in the table Assume that the tower of these and every Year vied to Maturity SVIM Coupon 17 Cand Price 1 Sow Foro 6.00 1. Click Submit to completenessement o . BD c to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts