Question: Save Answer A Moving to another question will save this response. Question 17 of 25 > Question 17 4 points Baruch Co. announced today that

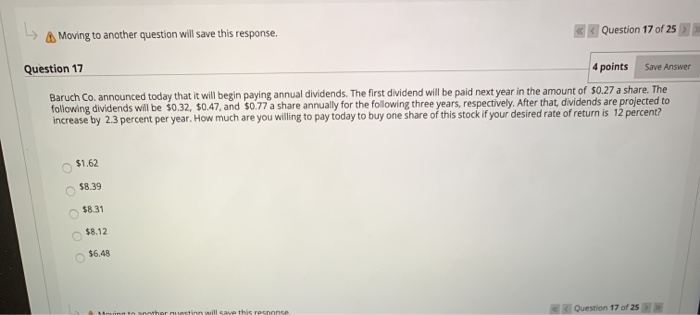

Save Answer A Moving to another question will save this response. Question 17 of 25 > Question 17 4 points Baruch Co. announced today that it will begin paying annual dividends. The first dividend will be paid next year in the amount of $0.27 a share. The following dividends will be $0.32 $0.47, and $077 a share annually for the following three years, respectively. After that, dividends are projected to increase by 2.3 percent per year. How much are you willing to pay today to buy one share of this stock if your desired rate of return is 12 percent? $1.62 $8.39 $8 31 C $8.12 $6.48 her nuestr will save this response Question 17 of 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts