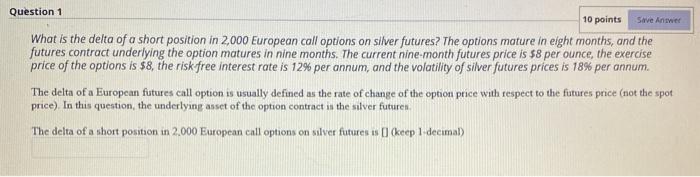

Question: Save Answer Question 1 10 points What is the delta of a short position in 2,000 European call options on silver futures? The options mature

Save Answer Question 1 10 points What is the delta of a short position in 2,000 European call options on silver futures? The options mature in eight months, and the futures contract underlying the option matures in nine months. The current nine-month futures price is $8 per ounce the exercise price of the options is $8, the risk free interest rate is 12% per annum, and the volatility of silver futures prices is 18% per annum. The delta of a European futures call option is usually defined as the rate of change of the option price with respect to the futures price (not the spot price). In this question, the underlying asset of the option contract is the silver future The delta of a short position in 2.000 European call options on silver futures is keep 1 decimal)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts