Question: Save Answer Question 1 20 points You work as a financial analyst at Wells Fargo. You are performing a lease analysis for a client who

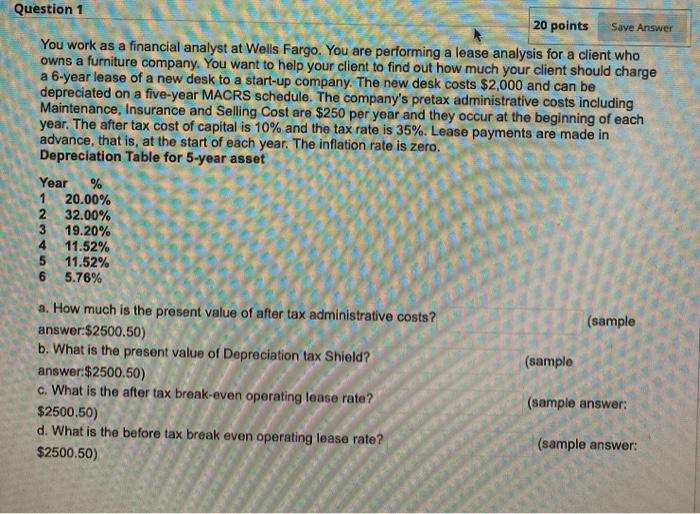

Save Answer Question 1 20 points You work as a financial analyst at Wells Fargo. You are performing a lease analysis for a client who owns a furniture company. You want to help your client to find out how much your client should charge a 6-year lease of a new desk to a start-up company. The new desk costs $2,000 and can be depreciated on a five-year MACRS schedule. The company's pretax administrative costs including Maintenance, Insurance and Selling Cost are $250 per year and they occur at the beginning of each year. The after tax cost of capital is 10% and the tax rate is 35%. Lease payments are made in advance, that is, at the start of each year. The inflation rate is zero. Depreciation Table for 5-year asset Year % 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76% (sample (sample a. How much is the present value of after tax administrative costs? answer:$2500.50) b. What is the present value of Depreciation tax Shield? answer:$2500.50) c. What is the after tax break-even operating lease rate? $2500.50) d. What is the before tax break even operating lease rate? $2500.50) (sample answer: (sample answer: Save Answer Question 1 20 points You work as a financial analyst at Wells Fargo. You are performing a lease analysis for a client who owns a furniture company. You want to help your client to find out how much your client should charge a 6-year lease of a new desk to a start-up company. The new desk costs $2,000 and can be depreciated on a five-year MACRS schedule. The company's pretax administrative costs including Maintenance, Insurance and Selling Cost are $250 per year and they occur at the beginning of each year. The after tax cost of capital is 10% and the tax rate is 35%. Lease payments are made in advance, that is, at the start of each year. The inflation rate is zero. Depreciation Table for 5-year asset Year % 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76% (sample (sample a. How much is the present value of after tax administrative costs? answer:$2500.50) b. What is the present value of Depreciation tax Shield? answer:$2500.50) c. What is the after tax break-even operating lease rate? $2500.50) d. What is the before tax break even operating lease rate? $2500.50) (sample answer: (sample

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts